Admirals is an international broker. The company has been operating on the Contracts for Difference (CFD) and Forex market continuously since 2001. It comes from Estonia and is listed on the Swedish stock exchange Nasdaq Nordic.

The company is regulated in five independent jurisdictions. As Admiral Markets UK Ltd, it is registered in Great Britain and authorized by the FCA: license number 595450. In Cyprus, it operates as Admiral Markets Cyprus Ltd and has CySEC authorization number 201/13. A further three offices are located in Australia (Admirals AU Pty Ltd, license number 410681), Jordan (Admiral Markets AS Jordan Ltd, license number 57026) and South Africa (Admiral SA (Pty) Ltd, license number FSP51311). All of them wholly form Admirals Group AS, which is a publicly traded company.

Until recently, the broker used the Admiral Markets brand, but in 2021 it underwent rebranding to Admirals.

Admirals offer

Admirals CFD instruments offer a wide selection of currency pairs, cryptocurrencies, stocks, stock indices, bonds and commodities. In addition, Admirals offers trading on real stocks and ETFs from around the world. Customers from Europe are subject to a company registered in Cyprus, thanks to which they can count on negative balance protection, financial leverage of up to 30:1 on selected instruments and access to the guarantee fund.

Admirals has a minimum deposit of €100 and spreads start as low as 0 pips. The broker claims that 90% of its orders are executed within 150 milliseconds, and the choice of strategy and investment style is not limited in any way.

Admirals complements its offer with fractional shares, an asset management service in cooperation with Finexware and copy trading, available from the Investor’s Cabinet level for logged-in broker users.

Forex

Admirals currency pairs offer 50 different instruments, including 5 majors, 23 minors and 22 exotic pairs.

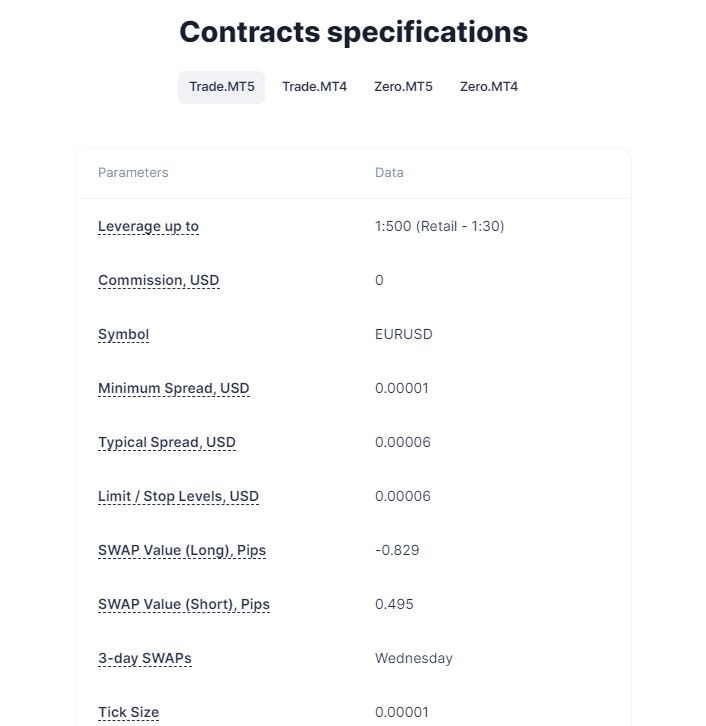

Each instrument has its own detailed page where you can see its price chart, the current bid and offer price, as well as data on the specifics of a given contract depending on the platform and account on which the trader is trading.

An example of an instrument specification on the Admirals platform for EUR/PLN. Source: Admirals

Commodities

Admirals offers 28 commodity CFDs, including 11 futures, 6 metals, 4 energy commodities and 7 agricultural commodities. Among them are the most popular ones, such as Brent and WTI crude oil, gold and silver, but also less popular ones, including orange juice, cotton and cocoa.

Indicies

Admirals provides access to 42 stock indices from around the world: 19 in the form of cash and 23 in the form of futures contracts. Traders can trade the largest indices from the most popular jurisdictions: including DAX 40, Dow Jones, Nikkei 225, Nasdaq 100, S&P 500 and so on.

Fees for index CFDs will vary depending on the type of region and currency in which they are denominated, similar to the stock market. The structure of commissions and fees is therefore discussed below.

Stocks

Admirals clients can access both CFD and real stocks. Currently, it is almost 3,500 CFD instruments, the vast majority of which come from stock exchanges in the USA, Great Britain and Germany. For real shares, the list is even longer and includes almost 5,000 items. All available assets can be checked here.

The structure of fees and commissions for CFD and real stocks is presented in the table below:

| Region | Stock CFDs | Real shares | ||

| Commission | Minimum commission per transaction | Commission | Minimum commission per transaction | |

| deer | 6 free trades every day*;

0.02 USD |

6 free trades every day*;

1.0 USD |

1 free transaction every day*;

0.02 USD |

1 free transaction every day*;

1.0 USD |

| Europe | 6 free trades every day*;

0.15% of the transaction value |

6 free trades every day*;

1.0 EUR, USD, GBP, CHF, 30 DKK, 10 NOK or SEK |

1 free transaction every day*;

0.15% of the transaction value |

1 free transaction every day*;

1.0 EUR, USD, GBP, CHF, 30 DKK, 10 NOK or SEK |

| Great Britain | 6 free trades every day*;

0.1% of the transaction value |

6 free trades every day*; £1.0, EUR or USD | 1 free transaction every day*;

0.1% of the transaction value |

1 free transaction every day*;

£1.0, EUR or USD |

| Asia and Pacific | 0.15% of the transaction value | 8 AUD or 1250 JPY | 0.15% of the transaction value | 8 AUD or 1250 JPY |

*For Stock CFDs: First 6 (six) one-way trades on Trade.MT5 account and/or first 3 (three) two-way trades on Trade.MT4 account. For Real Stocks: First 1 (one) unilateral trade in your Invest.MT5 account.

The Admirals offer also includes fractional shares (details), which allow you to invest in your favorite companies from just 1 euro or dollar while retaining the right to pay dividends.

At the same time, it is worth noting that the Admirals instrument search engine highlights which instruments allow you to trading in accordance with the principles of ESG, i.e. environmental, social and corporate governance.

Cryptocurrencies

The list of cryptocurrencies available at Admirals in the form of CFDs are in total 42 instruments. Of these, 32 are crypto/currency pairs and 10 are crypto/crypto pairs. Crypto/crypto pairs are the most popular tokens traded against Bitcoin: for example, ETH/BTC, LTC/BTC, and XRP/BTC.

In the group of crypto/currency pairs, there are all the tokens at the top of the total capitalization ranking, including Cardano (ADA), Bitcoin (BTC), Dogecoin (DOGE), Polkadot (DOT), Etherum (ETH) and so on.

Bonds

The bond trading offer in the form of CFDs at Admiral is quite modest and consists of two instruments, namely an instrument for the yield on 10-year US bonds and German bunds.

ETFs

ETFs are the last category of instruments available in Admirals and, similarly to shares, they can be traded in the form of CFDs and underlying instruments. On CFD ETF offer are 362 instruments, among others, from the French, German, English and American markets, most of them from NYSE Arca. The full list of physical ETFs includes over 500 items, which can be checked here.

In the case of CFDs on ETFs and physical ETFs, the fee pattern is exactly the same.The commission is USD 0.02 (minimum USD 1.0 per trade) for USD-denominated instruments. For European instruments, the commission is 0.15% of the transaction value (minimum 1 EUR, USD or CHF per transaction), and for British instruments 0.1% of the transaction value (minimum 1 GBP, EUR or USD per transaction).

Demo account – Admirals

The offer of the Admirals broker includes demo account which can be used for 30 days with the possibility of free extension. It allows you to check the possibilities of the platform and available instruments using virtual means, while having access to news and market data.

If you want to set up a demo account, go down to the lower parts of the Admirals home page by clicking the “Open demo account” button or use this link directly. In order to set up a demo account, you must provide basic data: country of residence, e-mail address, telephone number and password.

In order to activate the Investor’s Room, you need to confirm the data by clicking the link sent to the e-mail address provided. The demo account is available directly from the browser.

Admirals trading platform

The Admirals broker offers two popular Forex and CFD trading platforms: MetaTrader 4 and MetaTrader 5. The latter also allows you to trade based on real shares and ETFs. In addition, customers can take advantage of the browser version of MetaTrader known as WebTrader and proprietary Admirals mobile application available for Android and iOS devices.

As part of the MetaTrader platforms, Admirals also offers Addendum Supreme Edition, which gives access to technical analysis from Trading Central, the Global opinions add-on showing investor sentiment, a mini trading terminal and an extensive Admirals trading terminal modifying the basic functions of the platform.

Admirals reviews

On Trust Pilot, Admirals was rated “excellent” with 4.6/5 stars from 1,460 user reviews. 5% of the reviews awarded are 1 star due to dissatisfaction with the functioning of customer service due to “hidden fees” or delays in withdrawing funds. Admirals replies to all negative comments and tries to explain the situation or try to offer alternative solutions.

On the Google Play store, the Admirals app is rated 4/5 stars out of 906 reviews, with over 100,000 downloads. On the Apple Store, the rating is 4.5/5 stars out of 65 submitted reviews.