XTB is a Polish Forex broker that was established in 2004 and has been providing brokerage services since 2005. XTB is a laureate of numerous awards, incl. for one of the best in its class brokers in Eastern Europe.

It is regulated not only by the Polish Financial Supervision Authority (KNF), but also by the British Financial Conduct Authority (FCA), Cyprus CySEC and the regulator of the financial services market in Dubai (DFSA). The broker allows you to use their own trading platform XStation. The offer includes various accounts with spreads starting from 0 pips.

It is worth adding that XTB is one of the largest brokers in Europe, serving an average of over 100,000 active traders per month (data for 2021). However, the broker also operates in Latin America and the Middle East. XTB is also a broker listed on the Warsaw Stock Exchange (WSE).

Contents:

- XTB Shares – Quotation

- XTB Offer

- Types of accounts, costs, commissions, fees

- Demo account

- Investment platforms: xStation 5 and xStation Mobile

- Market news and education

- FAQ

- Summary

XTB Shares – Quotation

Check the current share price of the XTB broker on the chart below.

XTB Offer

The broker has a very wide offer that goes well beyond the Forex market. In total, XTB offers over 5,000 different instruments, ranging from Shares to cryptocurrency contracts. A list of all current instruments is available here.

Stocks

At XTB, we can buy physical shares, just like in a traditional brokerage house. What’s more, we have access to the shares of over 2,000 companies from 16 trading floors around the world, from countries such as: Belgium, the Czech Republic, Denmark, Finland, France, Spain, the Netherlands, Germany, Norway, Poland, Portugal, the United States, Switzerland, Sweden, Great Britain, Italy.

We are talking about the main trading floors from the above countries, i.e. NYSE, WSE, LSE or Euronext. What companies can we buy on these types of exchanges? They are rather companies with slightly more liquidity, so we do not have access to the entire offer of the above-mentioned exchanges. Nevertheless, from among more than 2,000 entities, it will certainly be possible to find interesting assets, such as Apple, CD Projekt, Amazon and BMW.

It is worth adding that XTB does not charge a commission on trading stocks, but with some reservation. Namely, no commission is charged for the monthly turnover of EUR 100,000. Transactions above this limit will be charged a commission of 0.2% (minimum 10EUR).

It is worth adding that XTB also allows you to submit the W8-BEN print, which allows you to reduce the tax on dividends from American companies from 30 to 15%.

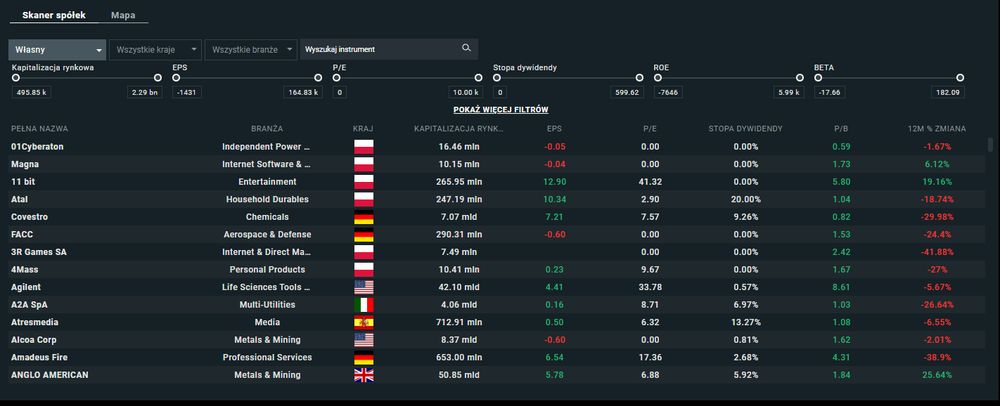

In the case of the stock market, XTB offers a market analysis tool as part of its investment platform: a company scanner and a map of the most popular of them.

Source: XTB (Stocks offer)

CFDs

CFD products are a specific type of instrument whose full name is Contract For Difference. It means that when buying a CFD contract, we do not really buy a specific asset, but we make a bet to change its price.

What is important with this type of instruments is the trading leverage. It allows you to conclude much larger transactions using much less capital. It is worth adding that this is a double-edged weapon, which allows you to maximize profits with small movements of the asset, as well as a very quick loss of deposited capital. In the case of XTB (as well as other European brokers), there is negative balance protection. It means that as a result of a failed transaction, we cannot lose more than we paid to the broker’s account.

Forex

XTB operates in the Market Maker model, which means that the broker himself animates the market on which we trade and is therefore the other party to the transaction. Offers access to over 50 currency pairs. According to information from the website, the spreads start at 0.8 pips on the most liquid pairs. It is also worth adding that in XTB we have the option of trading micro lots, and in addition, the broker does not impose a minimum deposit amount.

The xStation platform divides forex currency pairs into main (major), cross (minor) and emerging market currencies.

Indices

Stock indices are baskets of shares created by individual stock exchanges, most often they are the largest companies from the entire market (eg WIG20) or a given sector. In this way, indices give us exposure to the entire market of a given country, reducing the risk of worse results of a particular company.

XTB gives you the opportunity to buy these types of indices in the form of CFDs. We have over 20 indices from countries such as the USA, Germany and China at our disposal.

Commodities

Raw materials are other assets in the form of CFDs, giving exposures, inter alia, for raw materials such as Gold, Silver, Oil and Corn. At XTB you can trade more than 20 instruments of this type. They are divided into the following categories: agriculture, energy, industrial metals, precious metals, livestock and others ..

Cryptocurrencies in XTB

Cryptocurrencies are another category of CFD instruments. XTB offers access to dozens of popular cryptocurrencies, including Bitcoin, Ethereum, BNB and Dogecoin. Cryptocurrency spreads range from 0.22% to 3% depending on the liquidity of the asset.

In the case of the cryptocurrency market, XTB offers a maximum leverage of 2:1 and low transaction costs.

ETFs

An ETF (exchange-traded fund) is an exchange-traded fund that is listed on an exchange. They are generally characterized by lower management costs (commissions). They allow for investments in specific markets, industries or sectors of the economy, giving exposure to, for example, gold mining companies or the largest dividend companies.

Over 300 ETFs from all over the world are available at XTB. As with shares, the broker does not charge a commission on transactions up to a monthly turnover of EUR 100,000. The minimum transaction value is EUR 10.

If the transaction limit of EUR 100,000 is exceeded, the broker starts charging a commission of 0.2% (where the minimum value is EUR 10).

The investor can choose from over 330 ETFs listed directly on exchanges and from 150 additionally available in the form of contracts for difference. ETF CFDs allow you to easily implement long-term trading assumptions and build a sustainable investment portfolio. A big advantage of this solution is the possibility of using financial leverage.

XTB – types of accounts, costs, commissions, fees

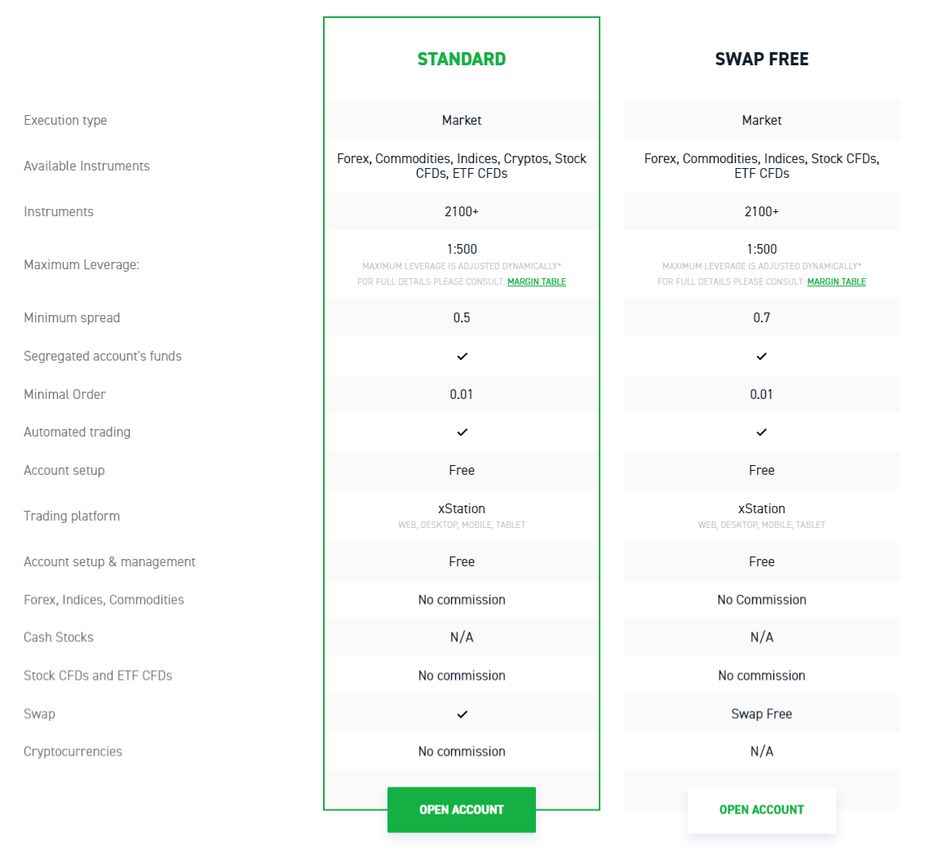

Keeping an account with XTB is free, and most of the costs are charged when concluding transactions. The broker currently offers two types of account called STANDARD and SWAP FREE.

The cost of payments to the account is PLN 0, and we can make them by ordinary transfer, using popular payment gateways. Commissions are charged for card payments. The minimum spread is 0.00008 (for the cryptocurrency market it is from 0.22% to 0.35% of the market price), the value of the minimum order is 0.01 lot (1 lot for shares and ETFs).

Withdrawals are also free, as long as we withdraw more than PLN 500.

In order to make deposits or withdrawals, the investor can use many solutions. The list includes bank transfers, credit cards and e-payments using the PayPal, BlueCash, PayU and Blik systems. Deposits and withdrawals are made from the investor’s room. Payments are processed by 14:30. This means that orders submitted after this time has been exceeded, will be processed on the next business day. The time of transferring funds from the moment of placing the instruction does not exceed 1 business day.

In the case of CFD products, spreads are charged at the time of trading, just like in a traditional exchange office. Also, if you hold CFD positions overnight, you may incur additional fees in the form of SWAPs.

However, when trading stocks and ETFs, the broker does not charge any commission for the monthly turnover of EUR 100,000. Above this amount, the commission is 0.2% (minimum EUR 10).

XTB offers also “Swap Free” account, where SWAPs are not charged but you have to pay a little more in spreads. There is also no cryptocurrencies contracts.

You can check accounts details here.

Source: XTB (Account types)

XTB Demo account

In addition to the real counterpart, XTB’s offer also includes a demo account, which allows you to get acquainted with the principles of the platform’s operation and carry out transactions on virtual funds.

In the demo version, access to the trading platform is not limited in any way, but after some time the account is blocked in order to open a full real account. You can set up a demo account from the XTB homepage or by simply clicking here. The user is asked to provide an e-mail address and country of origin, as well as to confirm marketing consents.

In the second step, it is necessary to provide the Name, telephone number and password. An account is created in seconds and you can log in to the XTB Demo trading platform immediately.

Investment platforms: xStation 5 and xStation Mobile

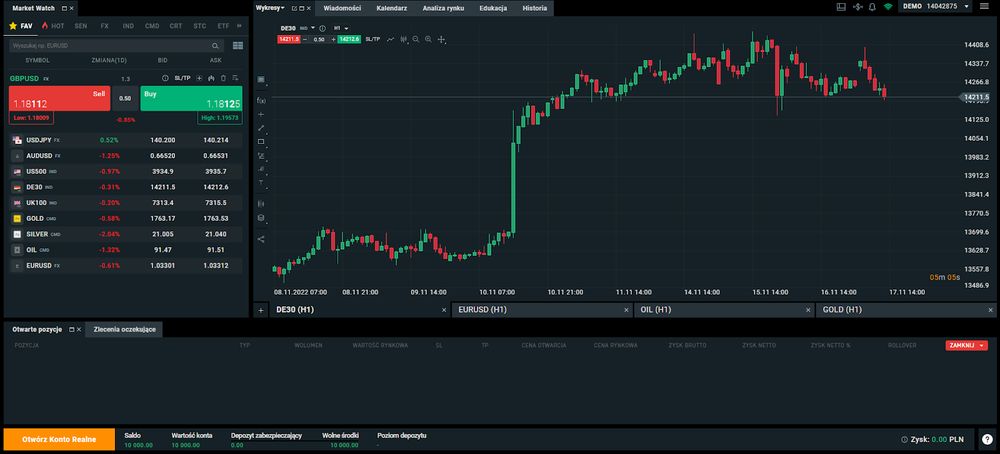

The XTB broker currently offers its users only its proprietary xStation platform. In the version for desktop computers, it is a browser-based web or desktop application called xStation 5, for mobile phones and tablets the xStation Mobile.

Source: STB (xStation platform)

Both in the mobile and desktop versions, xStation provides dozens of technical analysis and drawing tools that allow you to conduct in-depth chart analyzes. The platform also includes a news feed with the latest news, a macroeconomic calendar and an education section.

Market news and education

XTB places great emphasis on educating individual investors by organizing its own conferences with market experts, running daily webinars and an open portal with information and analyzes prepared by a team of brokerage house economists.

In the Education section, located directly on the xStation platform, recordings of basic indicators and trading rules are available, as well as archival recordings of educational webinars and conferences organized by XTB.

At https://www.xtb.com/int/market-analysis/news-and-research, you can find current information from the open access market as well as closed-access market analyzes and views, reserved only for real account holders.

FAQ

Below you will find answers to the most frequently asked question about the XTB broker.

Is XTB safe?

Yes, the XTB broker is one of the largest in Europe and has the necessary licenses, incl. KNF and FCA.

What is the minimum deposit on XTB?

XTB does not set a minimum deposit that you must make to start trading.

What can you invest in on XTB?

XTB offers access to CFD products on currencies (forex), indices, stocks, commodities and cryptocurrencies. Additionally, it also offers trading in common stocks and ETFs.

Is the account in XTB payable?

No, the broker only charges commissions on the transactions concluded.

How can I fund my XTB account?

The account is topped up by the customer panel in the xStation application via bank transfer, payment cards or Paysfae electronic wallets and BLIK transactions.

How can I withdraw funds from XTB?

Through the customer panel on the xStation platform, orders are accepted until 14:30 and are usually carried out within the business day from the receipt of information about the willingness to withdraw.

How much time do I need to open a trading account with XTB?

The process of setting up a trading account takes up to 15 minutes. After sending all documents to the broker and confirming the identity, the account is usually registered immediately, usually within no more than one day.

How to become a partner or IB in XTB?

XTB cooperates with affiliates and introducing brokers (IB). Information on this subject is available directly on the broker's website.

Is XTB a good broker for beginners?

XTB is the right choice for novice investors due to the intuitive xStation 5 platform, a wide selection of instruments and an extensive education department.

Summary

XTB is a broker with over 20 years of experience, as one of the few in the world is publicly listed on the stock exchange, and transactions using its xStation platform are burdened with a low level of risk (when it comes to the stability of the company itself).

In terms of the offer and trading conditions, XTB deserves a high note due to the wide selection of instruments and zero or low fees. It is a recommended choice for beginners and experienced investors due to its extensive educational base and continuous access to fresh materials.