EXANTE is an international STP broker, operating since 2011. Its offerings are primarily aimed at traders with market experience, while non-professional clients are not provided with access to options, futures, or contracts for difference (CFDs). A high deposit requirement of €10,000 is also a barrier.

However, the broker offers access to 50 markets and 600,000 financial instruments from around the world. It is regulated in Singapore and Cyprus, where it holds license number 165/12 (as EXT Ltd.).

Contents:

Exante Broker – Get to know his offer

EXANTE’s offerings are aimed at experienced traders seeking the best possible trading conditions and direct access to the live market. This includes Direct Market Access (DMA) , which allows clients to place direct orders on specific exchanges at the best possible price. It’s worth noting that the broker offers a wide range of financial instruments, including stocks, ETFs, currencies, metals, futures, options, funds, and bonds.

If you want to check the broker’s full offer and transaction costs, click here .

Shares in EXANTE

The EXANTE broker offers access to over 24,000 stocks across 50 financial markets , from the largest US stock exchanges to local European exchanges. Furthermore, the broker also offers access to a range of ETFs.

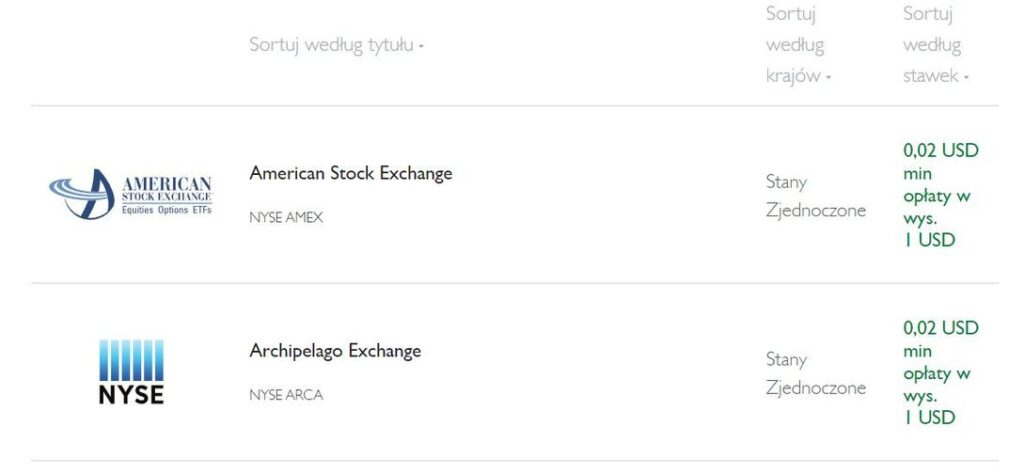

Commissions depend on the exchange on which you wish to trade and start at 0.02% per transaction (minimum fee is $1). Exante also offers shares listed on the Warsaw Stock Exchange, where the fee is a minimum of 0.4% of the transaction value, but no less than PLN 5.

” Investing in stocks is now easier than ever. Gain online access to over 24,000 stocks from around the world – all from a single account. Blue chips or new IPOs, massive US markets or local European stock exchanges – choose your preferences and create the perfect portfolio ,” broker EXANTE advertises its offer on its official website.

EXANTE share offer

A full list of available stock markets

can be found here

.

ETF Offer

In addition to tens of thousands of stocks, EXANTE also offers access to a wide range of ETFs for all purposes , regardless of whether an investor prefers high volatility or seeks a conservative trading strategy. The ETF market’s offerings overlap with those of the stock market.

The broker’s official website does not specify exactly how many ETFs are available on offer, but they come from the 50 largest global markets .

Forex at EXANTE

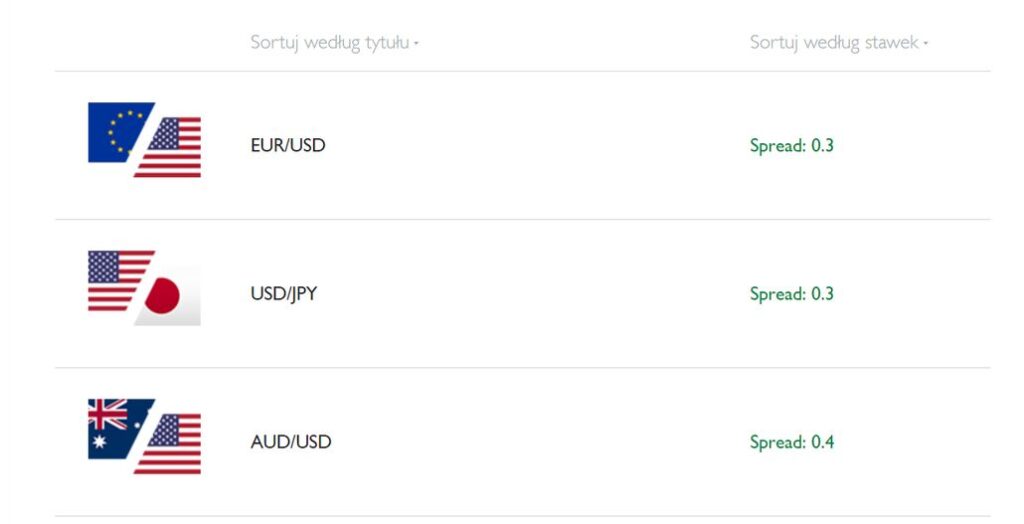

EXANTE offers clients 65 currency pairs in the form of CFDs . The broker’s website states that order execution time is just 10 milliseconds, and the spread on the EUR/USD pair is a mere 0.3 pips .

Example currency pairs on the EXANTE broker website.

The full EXANTE currency offer is presented here .

Metals

For those looking to trade gold, silver, copper, platinum, or palladium, the broker offers dozens of financial instruments that allow for this. These include futures, options, spot markets, and ETFs. The metals are available for exchange with over 10 currency pairs, with transactions completed within 10 milliseconds.

Commissions for the most popular instruments start at 0.005% for gold and silver, rising to $3 for copper or palladium.

Futures contracts (futures market)

EXANTE offers access to 30 global futures exchanges, such as CME, LIFFE, EUREX, and FORTS . This gives clients access to over 3,000 futures contracts, from commodities to bonds.

Due to the multitude of markets available, commissions will vary across each market. Detailed information is available here .

Options

Direct access to the options market on the world’s largest exchanges. According to the website, the EXANTE broker offers over 270,000 different options based on the most popular assets .

EXANTE Funds

Hedge Fund Marketplace is a place where clients can invest in over 200 hedge funds, guaranteeing investors reliability and security.

” Invest in funds with one click and monitor your positions in real time. Gain access to the most reliable and promising funds from around the world, through a single account, without leaving your desk! ” – this is how EXANTE advertises its offer.

Bonds

The final type of investment offered by EXANTE is bonds ( over 14,000 in total ). By opening an account with the broker, you gain access to both government bonds and private bonds . These include American, European, African, and Middle Eastern bonds. For investors seeking higher risk, the broker offers access to more exotic instruments upon request.

Moreover, you can access both bonds traded on stock exchanges and those traded over-the-counter.

Cryptocurrencies at EXANTE

Although there is no information on the EXANTE website that the broker allows investing in cryptocurrencies, a total of 150 different assets are available on the investment platform, quoted against the US dollar .

Thanks to this amount, the offer includes all the most popular tokens such as bitcoin (BTC) and ether (ETH), as well as those with lower liquidity and capitalization.

Fees and commissions at EXANTE

When it comes to fees with EXANTE, each instrument will have a different commission depending on the exchange and type . This is detailed in the tables linked above, for each asset class.

Regarding other fees charged by EXANTE, please note the following:

- Overnight Rates – Overnight rates apply to short and foreign exchange positions. They depend on market conditions and change frequently. Current overnight rates for short-term and foreign exchange transactions can be found in the client area.

- Short positions – short selling is possible from 12% for shares that are easy to borrow, i.e. the most liquid.

- Inactivity Fees – This is €50 per month if your account remains inactive for six months, has no open positions and your balance falls below €5,000.

- Other Fees – There is a one-time fee of €90 for trading any instrument on the platform, via the EXANTE Trade Desk.

- Negative Balance – Negative balances accrue interest. The exact interest rate depends on the currency of the negative balance.

EXANTE Platform

The EXANTE platform is available in desktop, web and mobile application formats. They provide access to 600,000 assets from a single account and are based on a network of 1,100 servers located around the world, ensuring users minimize latency and secure data transfer.

The EXANTE trading platform is available for both desktop and mobile operating systems: Windows, MacOS, Linux, iOS (also in the App Store), and Android (also in Google Play). Regardless of the version, each offers balance information, trading activity, access to real-time market data, an overview of current and historical positions, bond search, one-click trading, and account-to-account fund transfers.

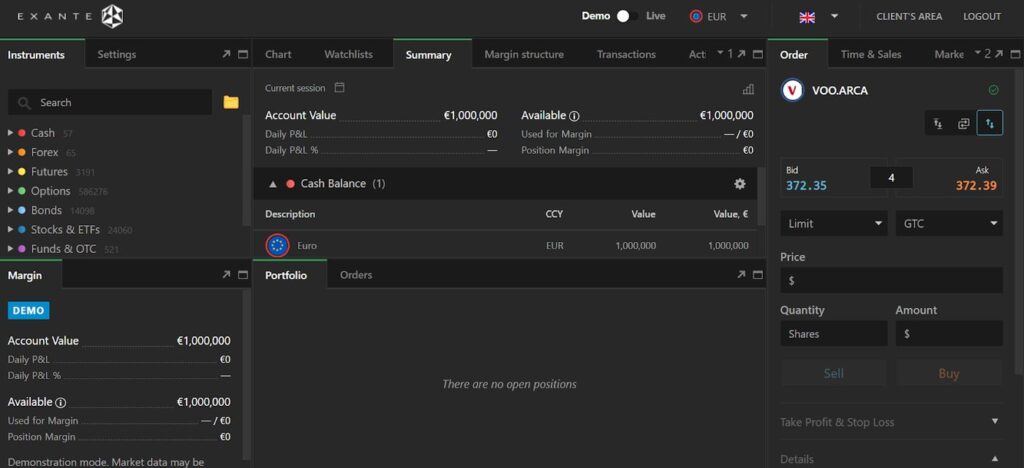

EXANTE broker’s web platform

The video below presents the capabilities of the desktop platform:

The mobile platform called Mobile PRO allows you to track open positions anywhere and provides access to the most popular indicators and technical charts.

Its operation is presented below:

DEMO account on EXANTE

Anyone wishing to test the EXANTE browser-based platform can do so without creating an account. Simply visit https://exante.eu/trade/ to access the full version of the platform in demo form.

The demo platform requires no registration or subscription, and clients have access to one million euros of virtual funds. This allows them to not only familiarize themselves with its operation and test available instruments, but also open positions on the virtual market.

Opinions about EXANTE

The EXANTE broker doesn’t have a representative number of reviews on Trust Pilot, which lists only a dozen or so reviews. However, in the Google Play app store, the rating is 4.3, with 256 reviews and over 10,000 downloads. The iOS app’s App Store also has a very low number of reviews. This may be due to the fact that EXANTE isn’t aimed at the majority of small individual traders, but rather at experienced investors with larger portfolios.

On the positive side , the trading platform offered is very powerful. Traders have access to over 50 markets worldwide to trade a total of over 600,000 instruments. This powerful platform, combined with other factors, makes EXANTE a good choice for engaging in algorithmic trading.

Among the downsides, clients cite the high minimum deposit requirement. The education department is also lacking compared to other brokers. However, this stems from the aforementioned fact that EXANTE doesn’t target small retail investors, but rather a specific group of experienced traders.

EXANTE – FAQ

Czy EXANTE jest bezpieczne?

Tak, jest to międzynarodowa firma inwestycyjna, która działa w wielu krajach już od 2011 roku

Czy EXANTE działa legalnie?

Tak, broker posiada licencje w Hong Kongu i na Cyprze.

W co można inwestować na EXANTE?

Broker oferuje dostęp do ponad 600 000 instrumentów z ponad 50 różnych rynków. Są to Akcje, Obligacje, Fundusze, Fundusze ETF, Waluty, Metale, Opcje czy Transakcje Terminowe.

Czy EXANTE oferuje konto demo?

W EXANTE można handlować w oparciu o rachunek demonstracyjny. W tym celu nie trzeba zakładać żadnego konto, ani dokonywać rejestracji, wystarczy przejść pod link: https://exante.eu/trade/

Jak wygląda platforma przeglądarkowa EXANTE?

Platforma posiada układ okien, który można modyfikować według własnego upodobania, przeciągając je i upuszczając w konkretnym punkcie ekranu.

Czy w EXANTE można handlować na polskich akcjach?

Tak, w ofercie EXANTE znajdują się wszystkie akcje notowane na GPW, a także instrumenty pochodne z warszawskiego parkietu.

Do kogo skierowana jest oferta EXANTE?

W związku na fakt, że minimalny depozyt w EXANTE wynosi 10 tys. euro, a broker nie oferuje zbyt wielu materiałów edukacyjnych, próg wejścia dla początkujących inwestorów wydaje się zbyt wysoki. Ogromna ilość instrumentów finansowych również może być przytłaczająca. Oferta jest więc typowo skierowana w bardziej profesjonalnych i doświadczonych inwestorów.

Czy w EXANTE można zainwestować w kryptowaluty?

Chociaż na stronie internetowej EXANTE nie ma o tym bezpośredniej informacji, to wchodząc w platformę tradingową brokera widzimy na liście ponad 150 kryptowalut. Wśród nich znajdują się wszystkie najpopularniejsze tokeny, a oprócz tego kryptowalutowe kontrakty futures oraz fundusze ETF.

Jakie opłaty ponoszą użytkownicy EXANTE?

Handel w EXANTE opiera się na prowizjach płaconych od realizowanych transakcji. Te będą różniły się od rodzaju instrumentu oraz giełdy, na której transakcja jest realizowana.

W jakim modelu działa broker EXANTE?

EXANTE to broker typu STP działający w modelu bezpośredniego dostępu do rynku (Direct Market Access, DMA). Oznacza to, że jest jedynie pośrednikiem w kojarzeniu swoich klientów z 50 giełdami na całym świecie, na których transakcje realizowane są bezpośrednio.