CMC Markets is an international CFD broker with 300,000 active clients worldwide, including Poland. It offers trading in stocks, currencies, cryptocurrencies, commodities, and raw materials.

CMC Markets UK Plc is regulated by the Financial Conduct Authority (FCA), registration number 173730. The German branch is supervised by the German Financial Conduct Authority (BaFin, Bundesanstalt für Finanzdienstleistungsaufsicht). Polish clients are served by the German branch, subject to regulations that are the same for all European Union markets.

A Brief History of CMC Markets

An investment company operating continuously on the market since 1989. Initially only as a Forex broker and under the name Currency Management Corporation, over time this was shortened to CMC, and in 2006, after rebranding, it took on its current form: CMC Markets.

CMC Markets was one of the first Forex and Contracts for Difference (CFD) brokers in the world to launch the MarketMaker online trading platform in 1996 , giving retail investors access to trading previously reserved only for institutional investors.

CMC Markets has been listed on the London Stock Exchange since 2016 and is currently one of the largest retail brokers operating in markets around the world, from the UK, through Poland, to New Zealand, Singapore and Canada.

CMC Markets Home Page

CMC Markets is currently operating dynamically, among others, on the Polish market. The branch was launched in 2015, expanding the company’s offerings to our domestic market and Eastern Europe. Clients can access the Polish-language website, make transactions in Polish złoty, and are served by Polish-speaking advisors and account managers.

CMC Markets broker offer

CMC Markets currently offers 12,000 different CFDs , including currency pairs, indices, commodities, stocks, bonds, cryptocurrencies, and ETFs. Details of each are presented below.

Forex

The broker offers over 330 currency pairs , including all major markets and dozens from emerging markets. CMC Markets notes on its website that it was one of the first in the world to offer online FX trading and continues its long tradition.

“We offer low and transparent spreads from just 0.7 pips and low position maintenance costs,” CMC Markets promotes Forex trading on its platform.

In addition to currency pairs, including those involving the Polish zloty, CMC Markets also offers access to proprietary stock market indices that track the value of a specific currency against a specific basket of FX instruments. These include the CMC USD Index and the CMC EUR Index.

Example spreads and costs for holding a position at CMC Markets

Shares at CMC Markets

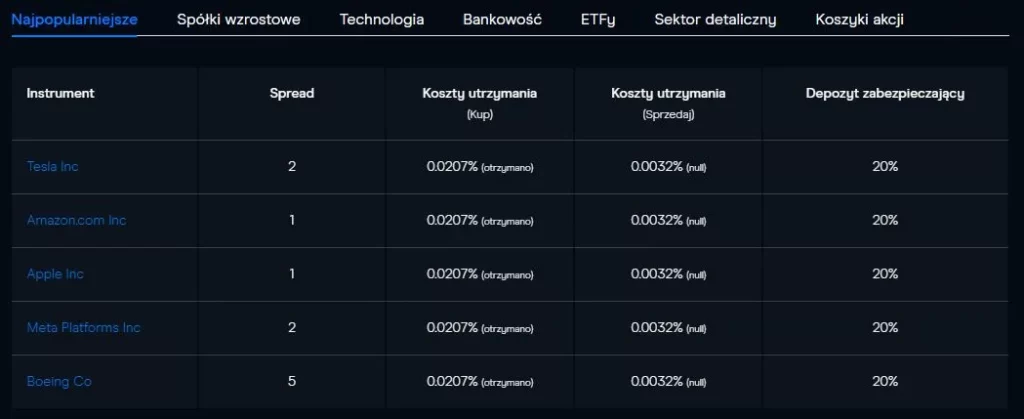

Shares currently represent the largest number of CFD instruments offered by CMC Markets. The broker allows trading in 10,000 different instruments from around the world, including shares of Polish companies and international giants such as Tesla, Facebook and Apple.

It should be emphasized at this point that CMC Markets does not offer access to real, physical shares, only CFDs on shares.

The commission for CFD trading on Polish shares is 0.18%. For transactions on instruments listed in the US and Canada, it’s 2 cents per share, and 0.1% for European shares. The margin ratio for CFD trading on shares starts at 20% (maximum leverage is 5:1).

Example costs of trading foreign stocks at CMC Markets

CMC Markets also allows you to trade CFDs on stock baskets prepared by the broker. Clients can gain exposure to various market sectors, from 5G-related companies to the renewable energy industry.

“Stock baskets include companies related to a given industry. These instruments offer the opportunity to gain broader exposure to a given industry compared to trading a single company. Trade across multiple sectors, including big tech companies, marijuana producers, Chinese technology companies, social media companies, and streaming services,” explains CMC Markets.

The annual maintenance costs of this type of baskets range from 2% for short positions and from about 5-6% for long positions.

ETFs and indices at CMC

The stock offering is complemented by CFDs on indices and ETFs . CMC Markets offers over 80 indices from the cash and futures markets . The broker offers attractive transaction costs – a 1-point spread during trading hours on indices such as the France 40 and a 1.2-point spread on the Germany 40. Available instruments include the FTSE, DAX, Dow, Nasdaq, and S&P 500, as well as regional indices from Australia, Asia-Pacific, the US, and Europe, including the Polish WIG.

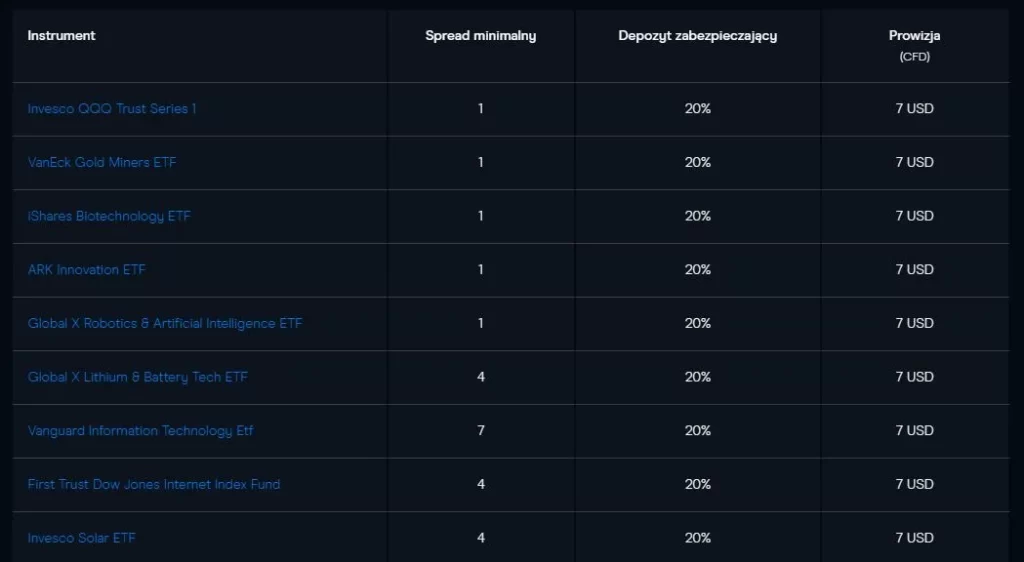

Additionally, CMC Markets offers over 1,000 ETF CFDs . This includes all the most popular ETFs from companies like Invesco, VanEck, iShares, ARK Innovation, and many others.

For German or US ETF CFDs, clients pay a flat commission of €5 (German ETF CFDs) or $7 (US ETF CFDs), regardless of position size. Furthermore, there are no daily holding costs, regardless of whether they are day trading or investing long-term.

Example ETF Trading Costs at CMC Markets

Bonds

Bond markets include government bonds such as Gilt, T-Note, and Bund. CMC Markets offers over 50 bonds from around the world , in both spot and futures markets.

Goods and raw materials

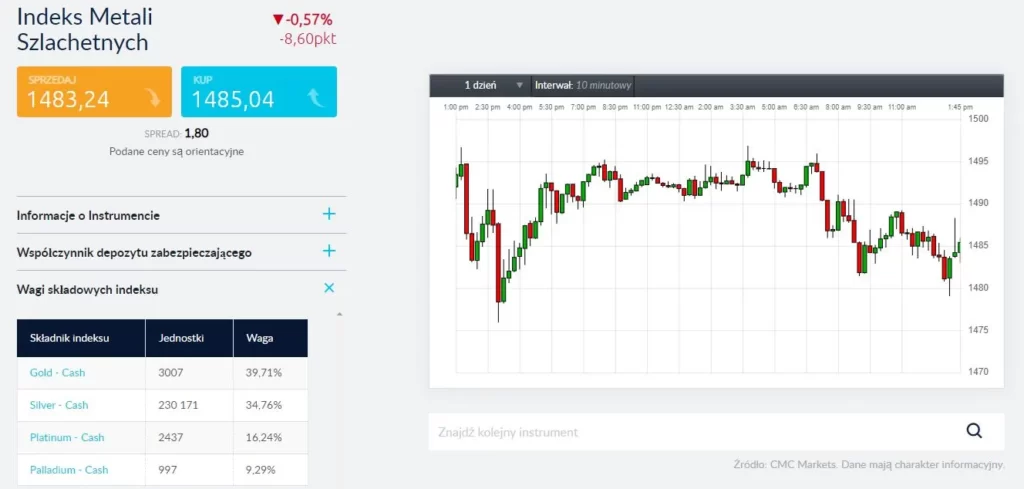

CMC Markets allows you to trade spot and futures commodities, such as crude oil, gold, and silver . Investors can take advantage of competitive spreads – 0.3 points on gold, 2.5 points on crude oil, and 0.3 points on natural gas. You can also invest in commodity indices, with a total of 120 instruments available. The most popular commodities, such as Brent crude oil and WTI crude oil, are available 24/7.

The offer is complemented by indices combining several different assets from this sector, for example an index of agricultural products or an index of energy products or precious metals.

Precious Metals Index. Source: CMC Markets

Cryptocurrencies at CMC Markets

CMC Markets offers 19 popular digital assets , and thanks to CFDs, you can trade them both short and long. The offering includes assets such as Bitcoin, Ethereum, Bitcoin Cash, Litecoin, and cryptocurrency indices.

It should be emphasized at this point that CMC Markets does not offer access to real, physical cryptocurrencies, only CFDs on digital assets.

Costs depend on the type of instrument. For Bitcoin, the minimum spread is 75%, and the daily cost of maintaining a position is 0.0959% (buy) or 0.0274% (sell). Maximum leverage for all cryptocurrency instruments is 2:1.

CMC Markets Costs and Commissions

The basic costs for each instrument are described above . In addition, CMC Markets may charge additional transaction costs, for example, for maintaining positions on stock and currency markets . Full details of position maintenance costs can be found here .

The holding cost for index CFDs is based on the interbank interest rate for the index currency (see table) plus 0.0082% for long positions and minus 0.0082% for short positions. The holding cost for stock CFDs is based on the interbank interest rate for the share currency (see table) plus 0.0082% for long positions and minus 0.0082% for short positions. The holding cost for short positions (Sell) for stock CFDs also takes into account the borrowing cost for the instrument on the underlying market.

Other costs include a subscription fee for CFD stock quotes, which is charged at AUD 20 and HKD 120 for Australian and Hong Kong stocks, respectively. However, for other countries, the subscription fee is zero.

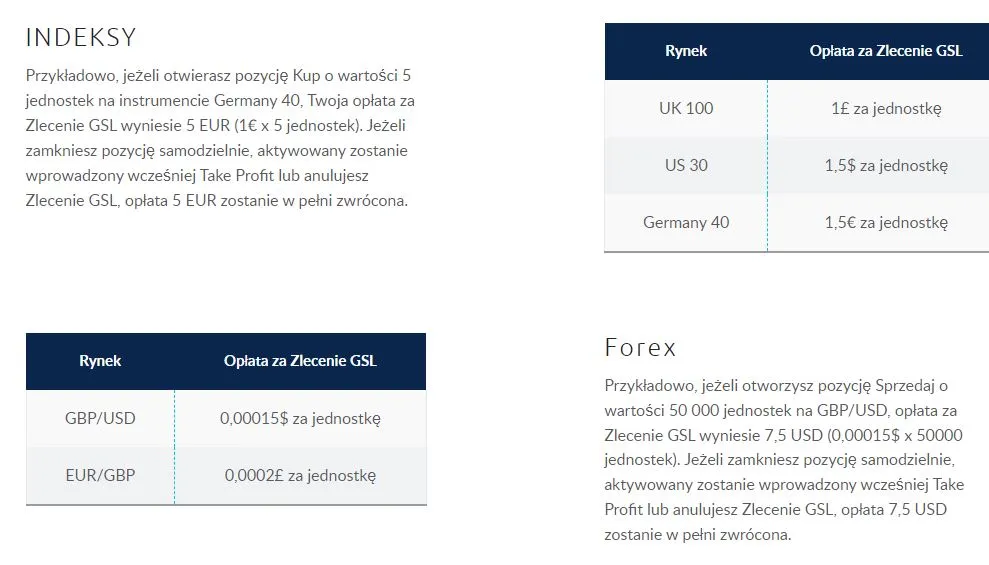

Additional fees also include the cost of a guaranteed stop loss (GSL) , which will vary depending on the instrument. For example, if an investor opens a short position of 50,000 units on GBP/USD, the GSL fee will be $7.50 (0.00015 x 50,000 units). If the investor closes the position on their own, a previously entered take profit is triggered, or the GSL is canceled, the $7.50 fee will be fully refunded.

Guaranteed stop loss fees for indices and forex. Source: CMC Markets

CMC does not currently charge any additional fees for inactivity on your account.

Live and Demo Accounts at CMC Markets

The CMC Markets broker offers access to live and demo accounts run either on its proprietary platform called Next Generation or on MetaTrader 4 , also giving you the option to open a demo account.

Opening a demo account simply requires entering an email address and password and registering on the broker’s website. You can then access the trading platform, which is accessible via a browser on any device: computer, tablet, or phone.

CMC Markets Platform – Next Generation

The target platform offered by the CMC Markets broker is Next Generation, prepared for mobile devices and personal computers. In addition, the offer also includes trading based on the popular MetaTrader 4 platform by MetaQuotes.

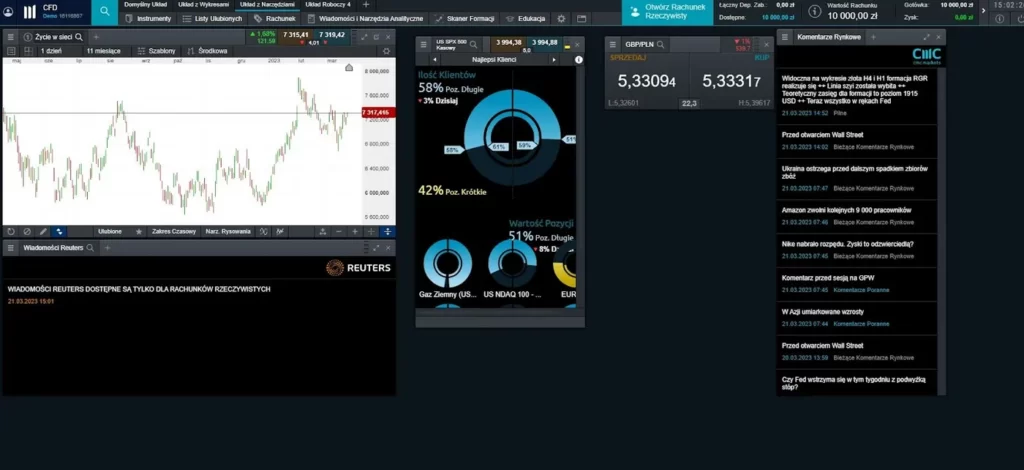

- The Next Generation trading platform can be easily tailored to investor requirements

- It features an advanced charting suite, including over 115 built-in technical analysis indicators and drawing tools. It also includes over 70 chart patterns and 12 chart types.

- It offers working layouts for more detailed analysis of market situations and a pattern scanner.

The CMC Client Positions tool allows you to monitor real-time data on the percentage of clients who have active buy and sell positions in a given financial instrument. Additionally, the tool also presents the share of these positions by value. Users can view data for all CMC Markets clients with open positions in a given instrument or limit the view to only those who have recorded profits in the last three months.

A look at the CMC Markets platform, showing the client position widget.

Mobile apps available for Android and iOS devices provide instant access to your account, live quotes, trades, and open position management. The app offers live charts, technical analysis indicators, drawing tools, the CMC Client Positions tool, and other useful features.

Instant notifications are available, allowing traders to set up push, SMS or email alerts to receive information about important market events, price alerts and executed orders.

You can find out more about the platforms and tools offered by CMC Marfkets here .

CMC Markets – Broker Reviews

On Trust Pilot, the CMC Markets broker has 1,570 reviews and an overall rating of 4 out of 5 stars (good).

On Google Play, the CMC mobile app has been downloaded over 500,000 times and rated 4.2 stars by over 2,500 users. However, the same app for iOS devices in the Apple App Store has received a total of 29 ratings and a rating of 4.1 stars .

The Polish branch also has a high rating on Google , namely 4.8 out of 5 stars.

Does CMC Markets charge fees for opening an account?

There is no cost to open a live account with CMC Markets. Traders can view the prices of Instruments free of charge and use tools such as charts, Reuters news or Morningstar analysis. However, an initial deposit to the account is required to start trading.

Does CMC Markets have regulation and oversight from financial commissions?

CMC Markets is a company licensed and supervised by the Bundesanstalt fur Finanzdienstleistungsaufsicht (BaFin) and registered under number 154814. In Poland, the company operates through its branch, CMC Markets Germany GmbH Spółka z ograniczoną odpowiedzialnością Branch in Poland, which is subject to the supervision of the Financial Supervision Authority with respect to its brokerage activities.

How does CMC Markets protect its clients' funds?

As a supervised investment company, CMC Markets is committed to strict guidelines for protecting funds entrusted by clients. To guarantee the safety of funds, CMC Markets keeps them in separate bank accounts, segregated from the company's assets. In the event that CMC Markets becomes insolvent or ceases operations, the funds held in these accounts will be returned to clients minus the administrative costs of handling them.

How does CMC Markets make money?

The main source of income for the company is spreads, while other fees, such as position maintenance costs, have a minimal impact on total revenues. CMC Markets never profits from client losses.

Is it possible to trade stocks at CMC Markets?

The CMC Markets broker provides access to 10,000 different stocks from around the world, including the Polish Stock Exchange. Note, however, that these are not real stocks, but contracts for difference (CFDs) on stocks. The customer does not purchase physical shares, only the contract. However, this allows you to trade with leverage and make money not only on increases, but also on decreases.

Does CMC Markets offer trading on cryptocurrencies?

Yes, the CMC Markets broker gives access to about 20 of the most popular cryptocurrencies. However, the user does not purchase tokens physically, but only CFDs, which allow him or her to bet on the declines or increases of a given asset, including with leverage.

What does CMC Markets do with customer information?

The company may use customer information to make further inquiries about customers, including checks to combat fraud. However, it does not sell customers' personal information to third parties for marketing purposes. For more information, please refer to the company's privacy and security policy, which explains in more detail how the company handles customer-provided personal information.

How do I fund my account at CMC Markets?

You can fund your CMC Markets account in the following ways: Credit/debit card - through your trading account, on the online platform or in the app. Bank transfer - through your online bank. PayPal - via your trading account, on the online platform or in the app.

How can I withdraw funds from my CMC Markets account?

In the platform or app, go to the Funds tab, then select Withdrawal. Then choose the withdrawal method: by card, bank transfer or PayPal. If you have registered a bank account with the broker, withdrawals ordered before the cutoff time will be processed the same day.

How is the cost of holding a forex position calculated?

Holding rates for FX are based on the tom-next rate in the underlying market for the currency pair and are expressed as an annual percentage, with an additional CMC Markets fee of 1%. To see holding rates for specific currency pairs, please refer to the Product Overview for the relevant pair.