How to verify Forex/CFD broker’s licence

Despite the fact that legal provisions in the whole world are continuously evolving (e.g. the newest MiFID II), investment frauds, otherwise known as scams, remain a true plague in the industry. Brokers acting without a licence each year defraud large amounts of capitals of aspiring investors. Therefore, if you are starting your adventure with investing in financial markets or you have come across an interesting broker’s offer, but you do not know, if they have a relevant authorisation, you can verify them at any regulator in a few steps.

Below, we will guide you through a process that will help you do this verification yourself.

- Ask for the license number.

Any regulated broker should make it clear about their license on the website. If it does not, or you cannot find this information, just ask the broker’s support for a license. You should get information on the regulator with which the license was granted (usually the country of registration of the company) and its number. - Find the page of the appropriate regulator.

Remember that the PDF file with the information about the license itself does not mean that the company has such a license. Often times, fraudsters counterfeit such licenses. For this reason, it is worth verifying it yourself on the website of the relevant regulator. So we go to the website of the regulator with which the broker is to have such a license. Below is a list of the websites of the most popular regulators:

- FCA (Great Britain) – https://register.fca.org.uk/s/

- CySEC (Cyprus) – https://www.cysec.gov.cy/en-GB/entities/investment-firms/cypriot/

- KNF (Poland) – https://www.knf.gov.pl/podmioty/wyszukiwarka_podmiotow

- ASIC (Australia) – https://connectonline.asic.gov.au/RegistrySearch/faces/landing/SearchRegisters.jspx?_adf.ctrl-state=90rt0tue_4

- Other european regulators: https://www.esma.europa.eu/investment-firms

- Search for your broker in the regulator’s database.

We will describe the process of checking the license using the FCA example, but for most regulators it looks very similar.

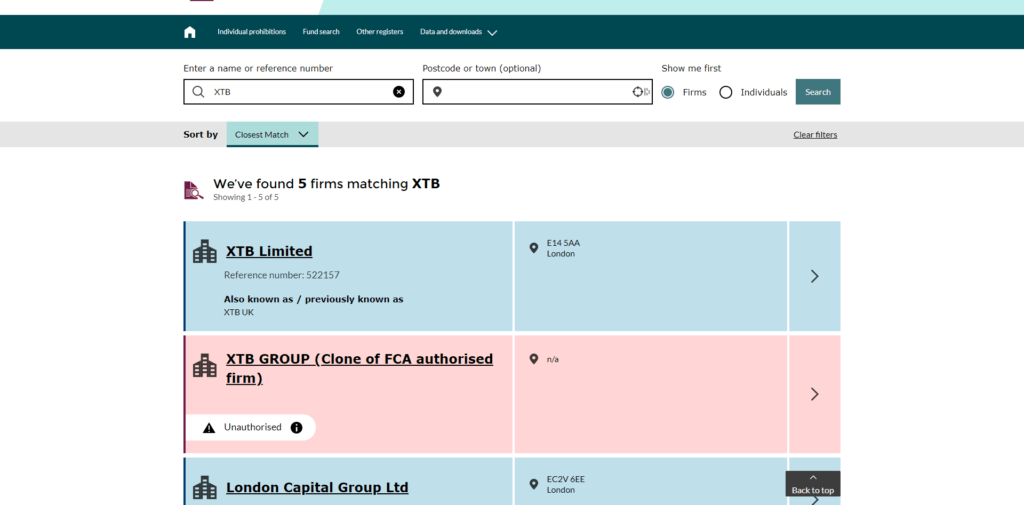

First of all, we are looking for regulated entities on the search engine page, where we enter the name of the company we want to check or its license number. As you can see in the example above, we saw a company with a license and immediately information about another company that operates illegally and pretends to be the regulated one.

As you can see in the example above, we saw a company with a license and immediately information about another company that operates illegally and pretends to be the regulated one. - Make sure you are talking to the same company.

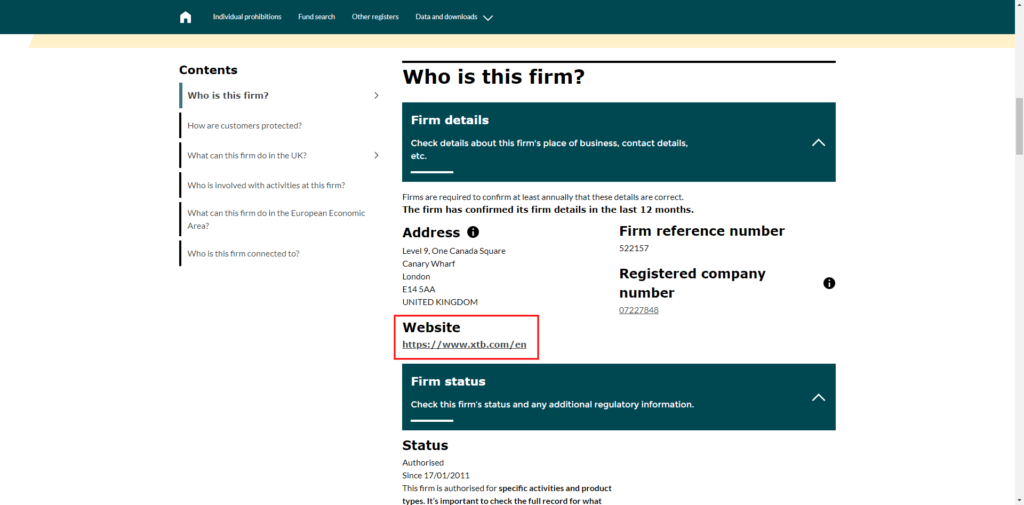

It is worth making sure that the company with which we intend to invest is definitely the licensed one, so we go into the details of the licensed company to check even things such as the website address.

- If any of the data do not match, it is possible that scammers are trying to impersonate a licensed broker! Such a signal should stop you from investing through the entity.