DEGIRO is a Dutch investment platform that allows trading on global stock exchanges. The company is not a CFD broker and does not offer forex trading, but it does offer leveraged products, including ETFs, futures, and options. However, the platform can be a good choice for stock trading. It offers a wide selection of companies listed on over 50 stock exchanges in 30 countries. DEGIRO’s Asian offering includes Japanese, Singaporean, and Hong Kong-based Chinese stocks.

Contents:

- DEGIRO offer

- Deposits and withdrawals

- Fees and commissions

- Lower US Tax (W-8BEN)

- Real and Demo Account

- DEGIRO platform

- Customer reviews

- FAQ

DEGIRO was founded in the Netherlands in 2008. In early 2021, the company merged with flatexDEGIRO Bank AG and has since become the largest online broker with a banking license in Europe. The platform is used by 2 million customers.

The platform supports nine currencies (including EUR, PLN, and GBP) and is available in 15 languages , including Polish. DEGIRO is regulated by the Dutch Financial Market Authority (AFM) and the prudential supervision of De Nederlandsche Bank (DNB). It is also registered with the Financial Conduct Authority (FCA).

DEGIRO broker and its trading offer

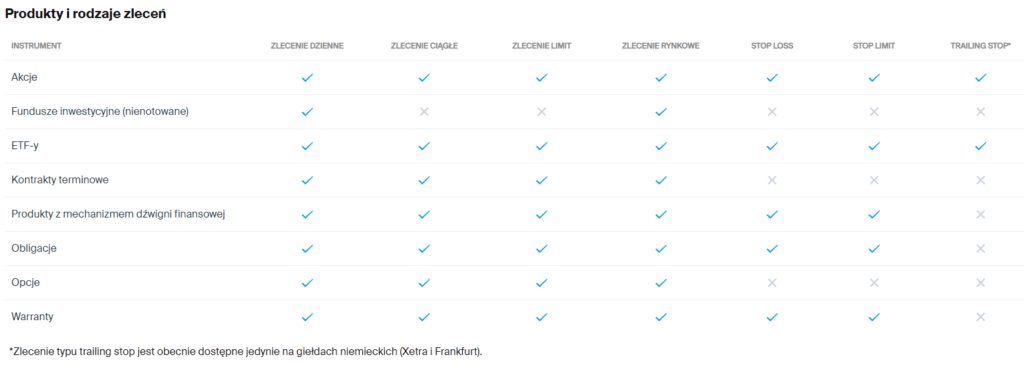

DEGIRO offers access to over 50 exchanges from 30 countries , allowing its clients to invest in stocks, futures, ETFs, and instruments related to the digital asset market.

Shares in DEGIRO

The platform gives access to shares from a huge number of exchanges. This is one of the widest offers available on the market. Available exchanges include: Euronext, Xetra, London Stock Exchange, NASDAQ, NYSE, NYSE MKT (AMEX), NYSE Arca, Currenex and the largest stock exchanges on the Asian market.

Investing fees vary by market. For US stocks, the commission is 0 PLN , but DEGIRO charges a €1 processing fee for each order.

For shares listed on the Polish WSE, the commission is PLN 1 + PLN 5 processing fee . For shares listed on the European and other markets, the commission is EUR 2 + EUR 1 processing fee.

A full list of available equity instruments can be found here .

ETFs at DEGIRO

DEGIRO also offers access to one of the broadest ETF offerings. The platform offers ETFs from most European exchanges, as well as from Hong Kong and Singapore.

The full list of available exchanges and markets includes : Euronext Amsterdam, Euronext Brussels, Euronext Paris, Xetra, Börse Frankfurt, Tradegate, London Stock Exchange, Vienna Stock Exchange, SIX Swiss Exchange, Bolsa de Madrid, OMX Helsinki, Athens Stock Exchange, Euronext Dublin, Borsa Italiana SpA, Oslo Stock Exchange, Warsaw Stock Exchange, Euronext Lisbon, OMX Stockholm, Hong Kong Stock Exchange and Singapore Exchange.

DEGIRO charges €0 commission for select ETFs, while for global ETFs it’s €2 per transaction and a €1 processing fee . The ETF offering is subject to a “Fair Use” policy. This means that the first executed order is free of transaction and third-party costs, regardless of size or direction, provided it doesn’t result in a short position.

Cryptocurrencies at DEGIRO

DEGIRO doesn’t offer direct cryptocurrency purchases . However, you can invest indirectly through trackers like ETFs and ETNs. Investing in cryptocurrency trackers carries a high risk, and the broker advises only investing in financial products that match your knowledge and experience.

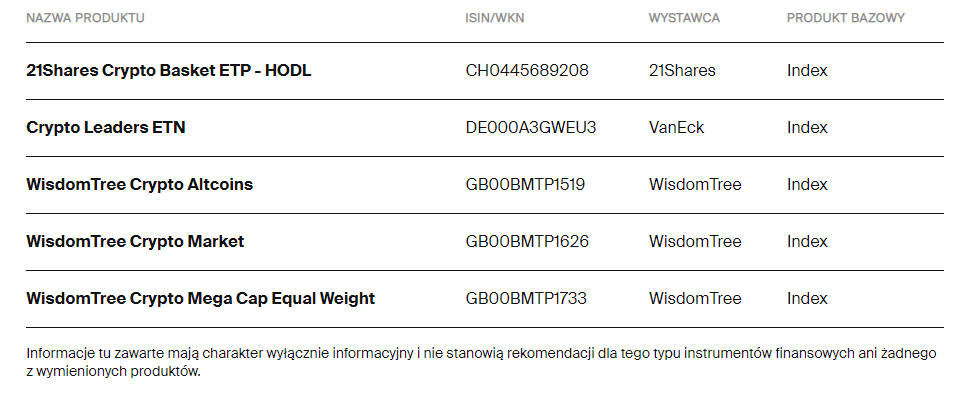

The indices tracking Bitcoin’s price include CoinShares Physical Bitcoin, WisdomTree Bitcoin, and 21Shares Bitcoin ETP. The offering also includes five instruments based on cryptocurrency baskets:

In addition, contracts issued by 21Shares for Cardano, Ethereum, Polkadot, Riiple and Solana are also available.

Bonds, Options and Futures at DEGIRO

The platform also offers access to bonds from European stock exchanges, options (Europe and the USA) and futures contracts (Europe and the USA).

In the bond market, the transaction fee is €2 + €1 handling fee . In the futures market, the commission is €0.75 per contract. A similar rate applies in the options market.

Additionally, DEGIRO allows you to invest in investment funds such as:

- Aberdeen standard

- BNP Paribas

- Blackrock

- Fidelity

- Goldman Sachs

- Kempen

- NN (formerly ING investment funds)

- Actiam

Forex Offer at DEGIRO

DEGIRO does not offer trading in forex or any other contracts for difference. The broker offers only real underlying instruments from major exchanges around the world.

Deposits and withdrawals of funds

You can deposit funds into your trading account via bank transfer to your DEGIRO account directly from your registered account on the platform (and only from there). Detailed information about deposits can be found by clicking the “Deposit/Withdrawal” button in the top right corner of the trading platform. In the mobile app, this section is available in the top left corner of the menu under the “Deposit/Withdrawal” button.

A standard transfer can take 2-3 business days to appear in your DEGIRO account . DEGIRO doesn’t offer fast transfers, but the platform does offer the option of using Trustly. This option incurs an additional fee of €1. Funds over €1,000 may take up to one business day to be credited.

As for withdrawals, they can be made from the same section (Deposit/Withdrawal) to your linked bank account. They take 3 to 5 days.

The company does not charge its clients additional costs for depositing or withdrawing funds.

Fees and commissions at DEGIRO

Fees for individual instruments are described in the sections above and are available at https://www.degiro.pl/oplaty-i-prowizje . Regarding other costs, DEGIRO does not charge, for example, inactivity fees or position maintenance fees. However, it does charge a 0.25% currency conversion fee.

If the order is placed through an exchange or other investment platform, a €1.00 handling fee applies for all products except select ETFs, Tradegate, and Options & Futures (excluding OMX Nordics). For shares listed on the Warsaw Stock Exchange, a €10 handling fee applies.

DEGIRO does not collect third-party fees directly, but rather through a €1.00 processing fee. This fixed fee covers all costs incurred in executing an order (e.g., clearing and settlement costs, brokerage fees, contract note fees, regulatory fees, and execution fees).

Lower tax on investments in US companies (W-8BEN)

DEGIRO allows you to receive a lower rate (15%) on dividends from US companies. The standard rate is 30%. To do this, you must complete the ‘W-8BEN/W-8BENE’ form, which is available on the platform.

The reduced tax rate applies to a select list of products available on the so-called “green list.” Almost all American products are listed on this list, with a few exceptions. Additionally, the product information page indicates whether this applies to the selected product.

DEMO account and real account

Creating an account with DEGIRO is extremely easy and only requires entering your email address, username and password. However, the company does not offer free demo accounts.

The decision is justified by the fact that opening a live account is completely free, allowing anyone to familiarize themselves with the platform before deciding to start trading. After registration, the user is asked to provide more detailed information, including phone number verification. This is necessary to access the trading platform.

DEGIRO platform

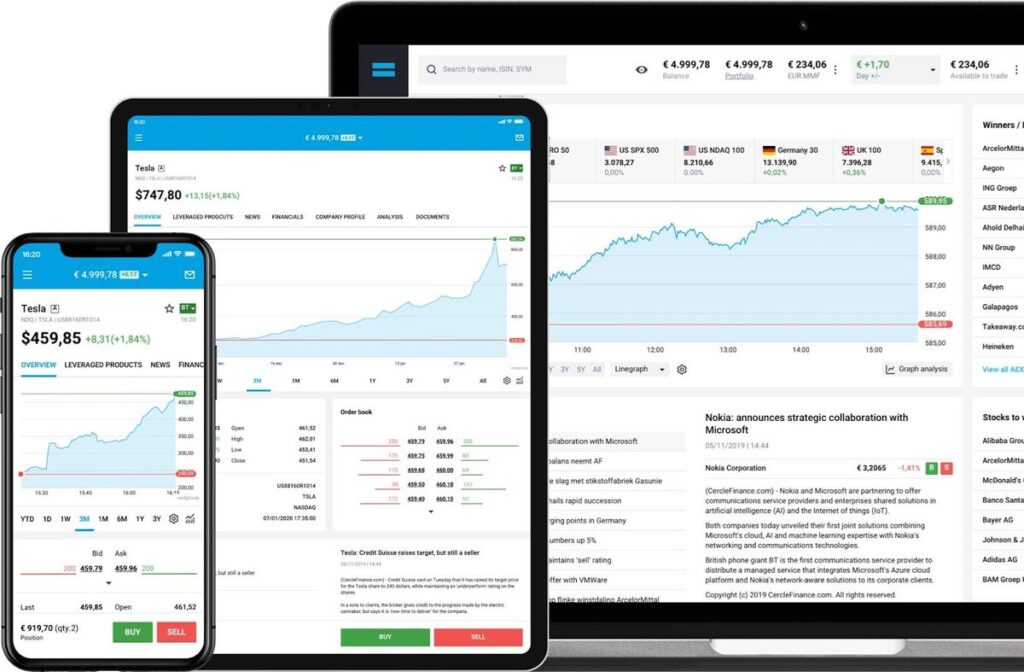

The DEGIRO trading platform is available as a web browser and as a mobile app . It’s tailored to every type of investor, and its appearance will vary depending on whether you’re a beginner, experienced, or expert investor.

Customer reviews about DEGIRO

On Trustpilot, the Polish-language website Degiro.pl received a rating of 4.6 out of 5 stars . Polish customers particularly appreciate the Polish-language support, low commissions, and wide range of options for building a passive portfolio.

The mobile app for Android devices has received a rating of 4.2 out of 5 stars from 13,700 reviewers. It has been downloaded on mobile devices over 1 million times. On the Apple App Store, the same app has a rating of 4.4 out of 5 stars from over 300 reviews.

DEGIRO FAQ

Is DEGIRO safe and operating legally?

Yes, the DEGIRO platform is supervised by the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) in Germany and the AFM in the Netherlands. In addition, the platform has an Investor Protection Program, which covers losses on unreturned assets up to 90% of them (with a maximum amount of up to €20000).

What can you invest in on DEGIRO?

DEGIRO offers access to instruments such as stocks, ETFs, futures, bonds and options.

Is there a fee for an account with DEGIRO?

No, account maintenance is free. Only fees/commissions related to transactions made and the conversion of funds appear.

Does DEGIRO offer a demo account?

At DEGIRO, you cannot trade on demo accounts, but you can set up a free real account and see how the platform works.

Is it possible to trade forex at DEGIRO?

DEGIRO is not an FX/CFD broker, so it does not offer typical trading on currency pairs. However, several currency-linked instruments can be found in the Futures offering.

Does DEGIRO offer cryptocurrencies?

At DEGIRO you will not purchase cryptocurrencies directly, but you can invest in exchange-traded derivatives based on the prices of cryptocurrencies or entire baskets of them. We are talking about futures contracts, ETFs and options.

How do I fund my DEGIRO account?

Funds can be deposited into an account at DEGIRO by bank transfer from a registered bank account. The processing time for such a transfer is usually 2-3 business days, and the company does not charge additional commissions on deposits.

Is it possible to invest in DEGIRO on the WSE?

Yes, DEGIRO has instruments on offer from the Warsaw Stock Exchange. In addition to shares, these will include futures contracts.

Does DEGIRO allow you to transfer your portfolio to another brokerage?

Yes, the customer has the option to make a transfer. In order to transfer all or part of the portfolio, please fill out the appropriate transfer request and send it to the email address [email protected].

Is DEGIRO an adjustable platform?

Yes DEGIRO is regulated by respected institutions in Europe and the UK. Its services are used by more than 2 million customers.