Israeli-based broker eToro is an investment firm focused on social trading, providing financial services and copy trading across a wide range of asset classes. The company is headquartered in Israel, but has offices around the world: Cyprus, the UK, the US, and Australia.

Contents:

eToro is regulated by local regulators in these locations. In Cyprus, it is licensed by the Cyprus Securities & Exchange Commission (CySEC) under license number 109/10, in the UK, it is authorised by the Financial Conduct Authority (FCA) under license number 7973792, and in Australia, it is regulated by the Australian Securities and Investments Commission (ASIC) under license number 491139.

eToro debuted in 2007 under the name RetailFX, founded by two brothers – Yoni and Ronen Assia, and David Ring. Yoni Assia remains CEO of the company, which generated revenues of $1.2 billion in 2021. eToro is valued at $8.8 billion in 2022 and is arguably one of the largest retail brokers in the world.

*eToro is a multi-asset platform which offers both investing in stocks and cryptoassets, as well as trading CFDs.

Please note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 61

This communication is intended for information and educational purposes only and should not be considered investment advice or investment recommendation. Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

Take 2 mins to learn more

eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity specific information about eToro.

eToro Broker – Offer

eToro is a Contracts for Difference (CFD) broker, but it tries to build its offer around a proprietary investment platform focusing on social investing (social trading) and copy trading.

At eToro, you can benefit from the knowledge of millions of users from over 140 countries and follow their trades, or become an investor yourself that others will follow and whose portfolio they will want to replicate.

As part of the Popular Investor program, you can select investors to suit your needs: depending on how much risk you want to take and whether you are investing long-term or short-term.

Here you will find a full range of markets available on eToro.

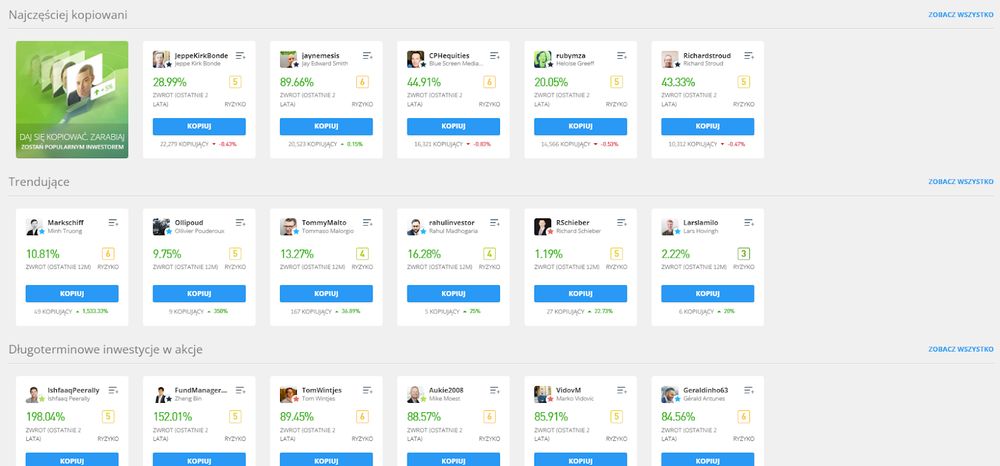

An overview of popular social trading investors at eToro. Source: eToro [ Past performance is not an indication of future results. ]

eToro copytrading with CopyTrader

eToro’s CopyTrader technology is an extension of social trading tools that allows you to automate your trading processes and copy trades from the best. The average annual profit of the most frequently copied investors exceeded 30% (data for 2021).

eToro copytrading via the CopyTrader service is available after registering for the platform, with no additional management fees. Simply select the trader you wish to copy. You can filter available traders based on performance, assets, and risk exposure. Then, you set your investment amount and click COPY.

Details of the Copy Trading offer can be found here .

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Three steps to getting started with eToro coytrading. Source: eToro

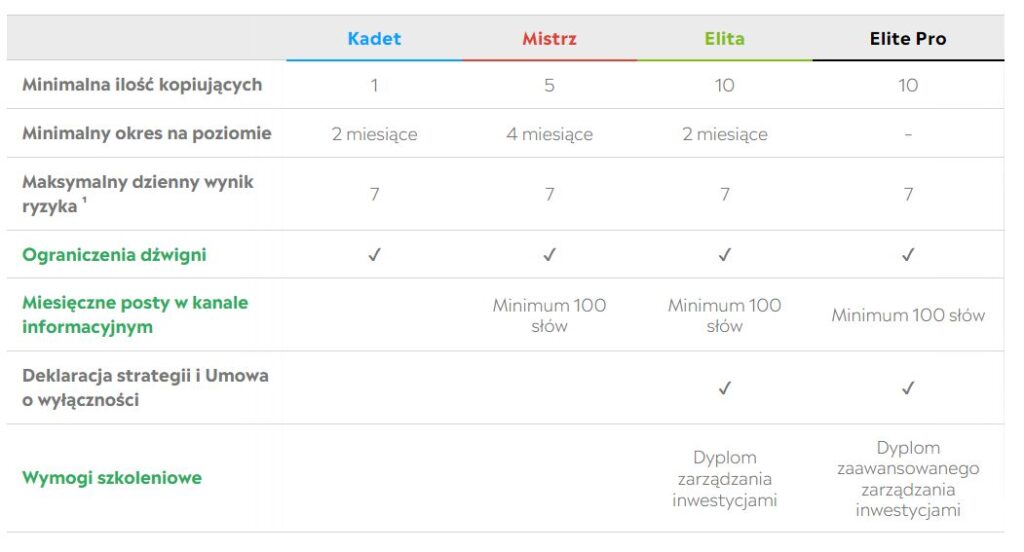

Copied investors receive compensation through the Popular Investor program. If you’d like to join and earn with eToro, please visit this link .

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk.

Requirements for Popular Investors. Source: eToro

Forex at eToro

eToro offers access to 49 of the most popular currency pairs , including the Polish zloty (EUR/PLN and USD/PLN). Spreads start at 1 pip.

In the main panel of the platform, the investor sees currency pairs along with recent price changes, buy and sell prices, as well as the sentiment among other eToro clients regarding a given currency pair.

Goods and raw materials

At eToro, you can trade 27 different commodity CFDs . The offering includes the most popular ones, including gold, silver, oil, and more.

Stocks and indices

eToro offers 19 of the largest stock indices from around the world , primarily from the US and European markets. When it comes to stocks, the offering includes the largest companies from US stock exchanges, as well as from the largest stock exchanges in Europe and the Hong Kong Stock Exchange.

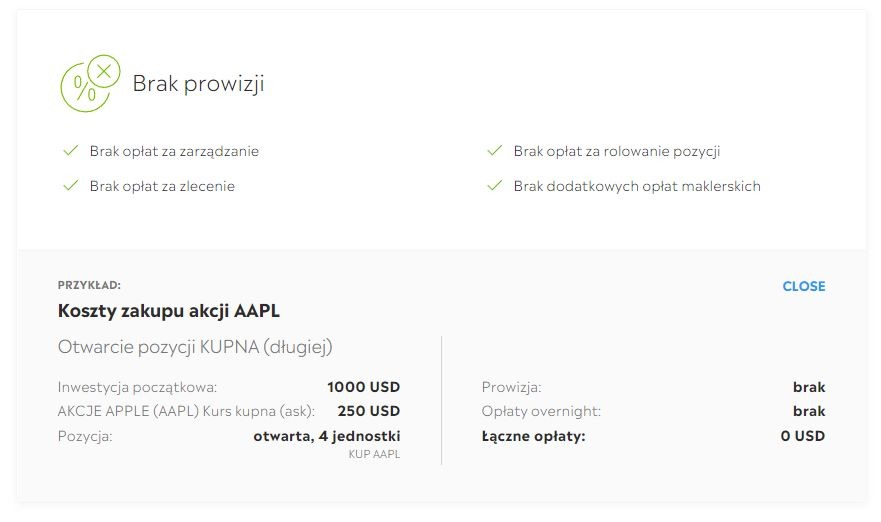

Stock investments are commission-free (0%), and the broker does not impose transaction limits on investors. Rollovers are also free of charge, as are additional brokerage services. However, it’s worth noting that other fees may apply.

A stock investor can benefit from a total of over 3,100 CFDs and real shares from NYSE, NASDAQ, London, Hong Kong, Frankfurt, Paris, Sydney, Zurich, Stockholm, Madrid and Milan.

ETFs

The ETF group is another extensive category of instruments offered by the eToro broker. There are 265 of them in total and these are the most popular instruments: again mainly from American Wall Street. eToro offers ETFs both as underlying assets and as CFDs.

eToro Commissions and Fees

The eToro broker offers one account type for all its users and, as mentioned above, when describing the offer of individual instruments.

Opening and maintaining an account is free of charge.

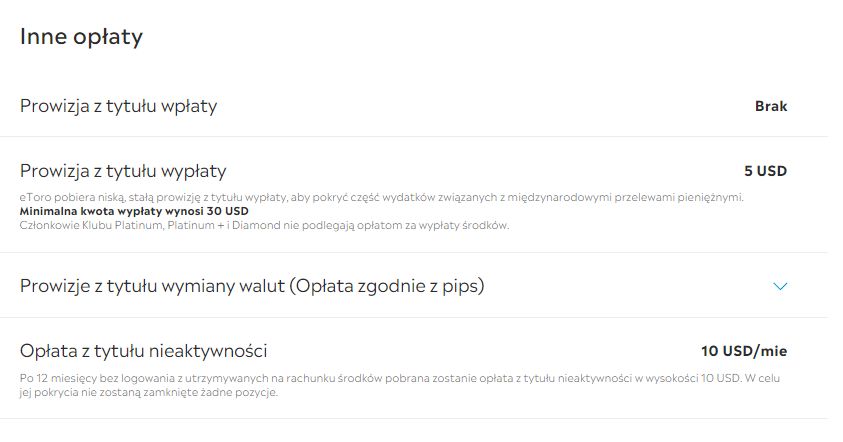

However, eToro has a list of “other fees” that shows it charges a $5 commission on each withdrawal . It explains that this is to cover some of the expenses associated with international transfers. The minimum withdrawal amount is $30. Platinum, Platinum+, and Diamond Club members are not subject to withdrawal fees. These Clubs are open to investors with at least $25,000 in platform capital.

A fee is also charged for user inactivity and is $10 per month. This fee is charged when an investor fails to log into their account for 12 months. However, to cover the fee, eToro brokers do not close positions.

Here you will find the full table of fees. *61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

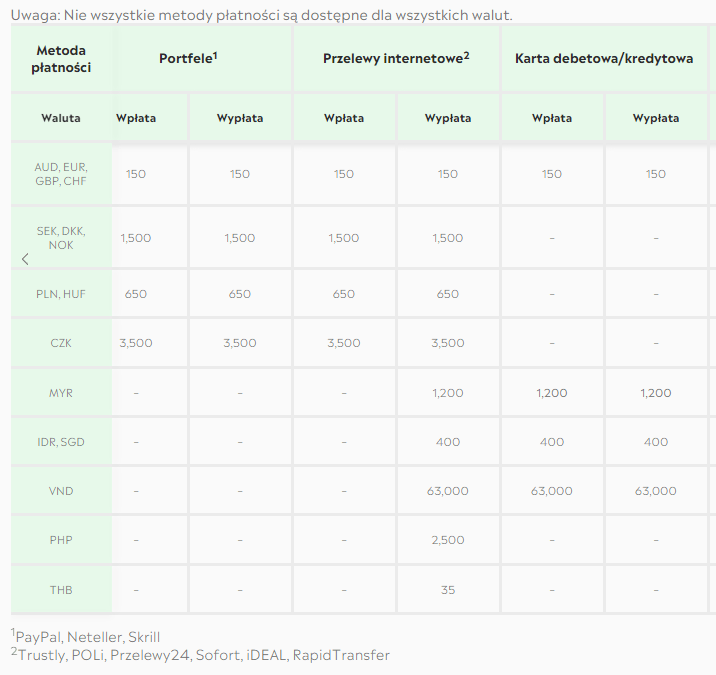

Also important for investors who do not use dollars is the table regarding currency exchange commissions. The values in the table below are given in pips:

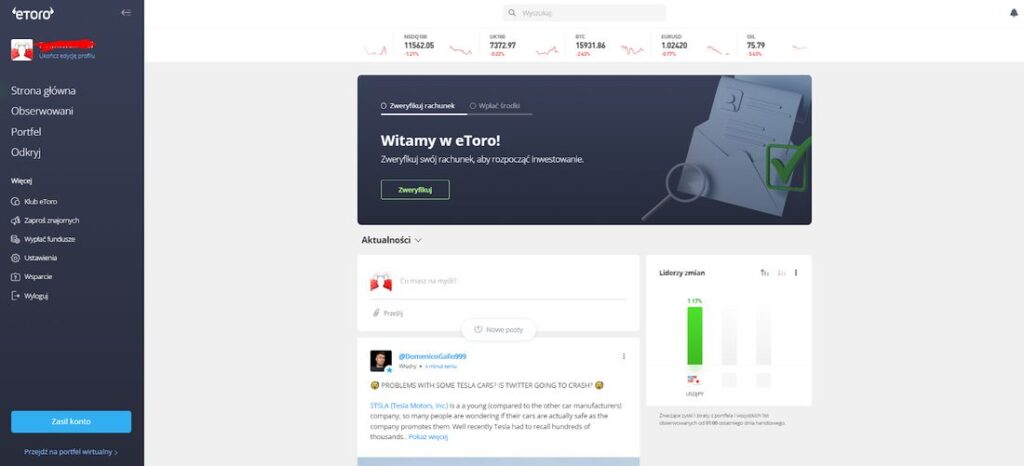

eToro investment platform

The eToro broker has its own proprietary trading platform , which you can register for by providing your username, email address, and password, or by using your Google and/or Facebook account. Before completing your account details and depositing funds, the platform will operate in an “eToro demo” format, allowing you to familiarize yourself with its functionality and all the necessary tools.

The platform is available in Polish , but you must change it manually from your profile settings. The main screen of the web platform looks like this:

Navigating to a selected instrument reveals basic information about it, the latest news, a simplified chart, and social media posts from other users related to the asset. Viewing the full chart provides access to drawing tools and technical indicators.

eToro also offers a mobile app , available in both the Android and iOS app stores. In addition to the basic eToro app, you can also download the eToro Money app, which allows for cheaper cash transfers to and from the platform .

eToro demo

The eToro broker also offers access to a demo version of its platform and account, allowing you to practice investing in an account that is funded with a virtual $100,000.

You can open a free demo account at eToro in three easy steps by clicking here .

*61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

With a demo account, you can invest in over 3,000 markets offered by eToro, including stocks, cryptocurrencies, commodities, currencies, indices, and ETFs.

eToro reviews

The eToro website features “real eToro user reviews” posted via Trustpilot. Out of a total of over 17,000 reviews, the broker received an average score of 4.3 on a five-point scale, which seems to be a positive result.

In app stores, eToro has an average rating of over 4.1 out of a total of 125,000 reviews.

The broker is considered safe by traders, primarily due to regulation by the most respected financial agencies in the world.

FAQ

Below you will find the most frequently asked questions by eToro customers.

What fees does eToro charge?

eToro does not charge additional fees for transactions or deposits. Fees apply to withdrawals, spreads, rollovers, and currency conversions from non-USD currencies.

Does eToro offer CFD trading?

eToro allows investment in underlying assets and Contracts for Difference (CFDs) across currencies, commodities, indices, stocks, and ETFs.

Which stocks are covered by the zero-commission offer?

For clients in CySEC and FCA regulated regions, all stocks are commission-free. For those under ASIC regulation, only US stocks are commission-free. Zero commission applies only to unleveraged stock purchases and does not cover CFD contracts.

How to copy others on eToro?

eToro offers the CopyTrader feature, allowing you to observe professional traders' activity and copy their transactions in real-time. eToro also provides ready-made investment portfolios that can be copied via Smart Portfolios.

How much does Copy Trading cost on eToro?

eToro does not charge extra fees for copy trading; however, trading and transaction spreads apply.

Can other users copy me?

If you create a public profile, other investors will see your transactions. To allow others to copy you, you must join the Popular Investor program, which offers additional earnings.

When investing on eToro, do I buy real shares?

Yes, you can purchase real shares. However, CFDs on shares are also available.

Does eToro pay dividends?

On eToro, real share holders receive dividends proportional to their holdings, provided the company issues them.

How can funds be withdrawn from the platform?

Through the client panel, using the 'withdraw funds' option with a credit card, bank transfer, or e-wallets.

What is the minimum deposit on eToro?

For Polish users, the minimum is 100 dollars. However, bank transfer deposits must exceed 500 dollars. Business accounts require an initial minimum deposit of 10,000 dollars.