US inflation is accelerating again. One reason may be Trump’s tariffs

Inflation data for June may cool investors’ hopes for quick interest rate cuts in the United States. According to economists’ forecasts, the PCE consumer spending index will reach its highest since February this year.

Rising inflation could delay Fed’s interest rate cuts

According to the predictions of analysts surveyed by Dow Jones Newswires and The Wall Street Journal, the Fed’s preferred measure of inflation, the PCE, rose at an annualized rate of 2.5% in June (May’s result was 2.3%). The increase confirms earlier CPI index data, also signaling a rebound in inflation, which is still above the central bank’s target (2%). Exceptionally important here is also the core PCE inflation index, which excludes food and energy prices – this one, according to economists, is likely to remain at 2.7%.

One reason for the price increases may be the tariffs introduced by Donald Trump. According to Deutsche Bank, for some time, some companies may have refrained from hikes by taking advantage of previously accumulated product inventories, but inflation data from June will likely already reflect the passing on of costs to the consumer. As the economists argued in a commentary, the fresh data “provided clearer evidence” that tariffs are translating into “higher prices for goods such as household furnishings and toys,” as well as products in “other categories.”

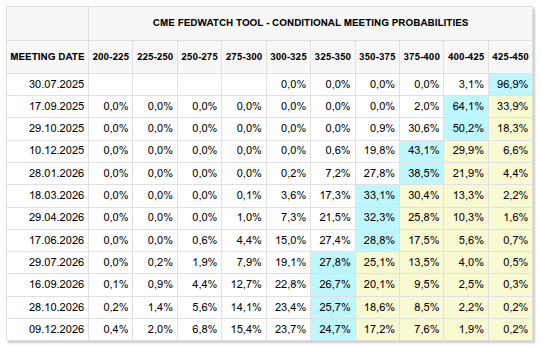

Probability of rate cuts at upcoming Fed meetings. Source: CME Fedwatch

It was the tariffs and their lagging effect on the economy that kept Jerome Powell and the Fed from cutting rates, something that Trump commented on extensively in his posts , criticizing the bank for being tardy. Now that many people associated not only with Wall Street, but also with US politics, are hoping for imminent rate cuts, the latest data may cause the Fed to once again play conservative at its next meeting on Wednesday, keeping the cost of debt at high levels.

According to the CME FedWatch futures market research tool, this is exactly what investors are currently assuming. At the same time, markets are pricing in a roughly 64% probability of a rate cut in September, but this scenario could be challenged if inflation data continue to be unfavorable.