Central Banks: Inflation is a bigger threat than Omicron

In the last two years, the main challenge has been to predict the next consequences of the coronavirus. The primary focus was on easing the virus’s impact on growth and jobs. Now the priority is to limit prices.

Central banks in Europe and the United States have focused on introducing more restrictive policies. The protection of production and employment against the further effects of the COVID-19 pandemic is of secondary importance. Although the COVID-19 pandemic will not disappear overnight, Western countries are already figuring out how to live with it. However, the impact of each subsequent mutation of the virus will be smaller than the previous one.

The President of the European Central Bank, Christine Lagarde noted that:

Society has become better at coping with the pandemic waves and resulting constraints. This has lessened the pandemic impact on the economy.

In the opinion of Mark Cabana, head of the interest rate strategy of one of the world’s largest banks – Bank of America:

It does not seem that the Fed or other central banks are feeling it necessary to ignore the very strong signals and elevated inflation readings they’ve seen just because of Covid.

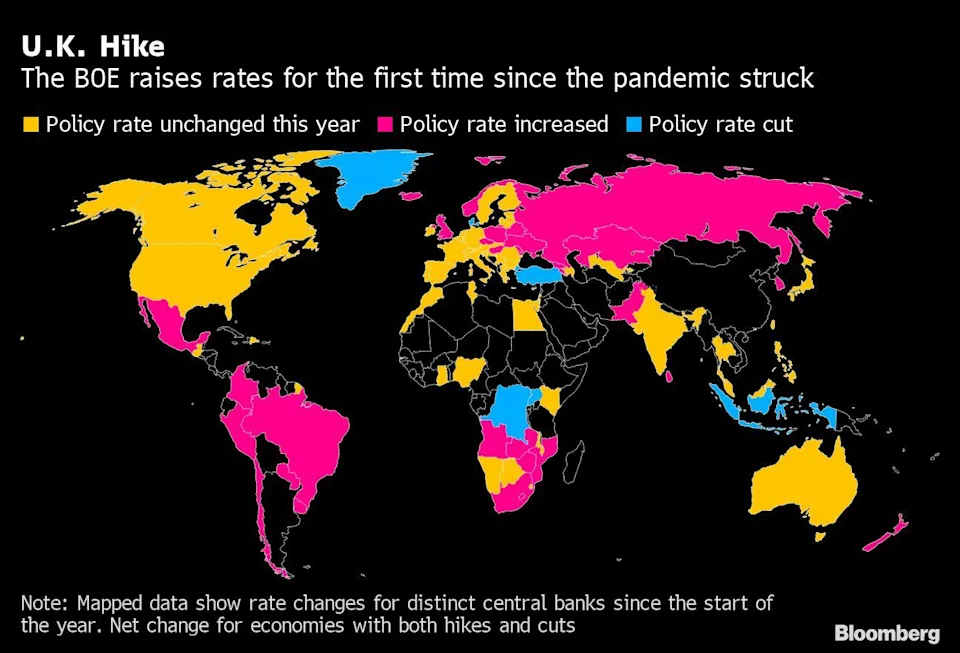

Banks’ response to inflation

The Bank of England raised interest rates from 0.1 per cent. up to 0.25 per cent The Federal Reserve System has announced that it will accelerate the completion of its bond purchase program and plans three interest rate hikes next year. On the other hand, the European Central Bank was more cautious. The ECB announced on Thursday that although it will end the temporary asset purchase program (PEPP), it will continue the earlier APP program. The APP program will be continued as long as it is necessary to strengthen the accommodative impact of interest rates.

Central banks see the risks associated with the coronavirus as diminishing. They emphasize that their tolerance to price pressure is running out. Until recently, central bankers argued that the price increase would not be long-term. They are currently withdrawing from this position.