Over $1 billion was recovered from the Stanford Allen Pyramid

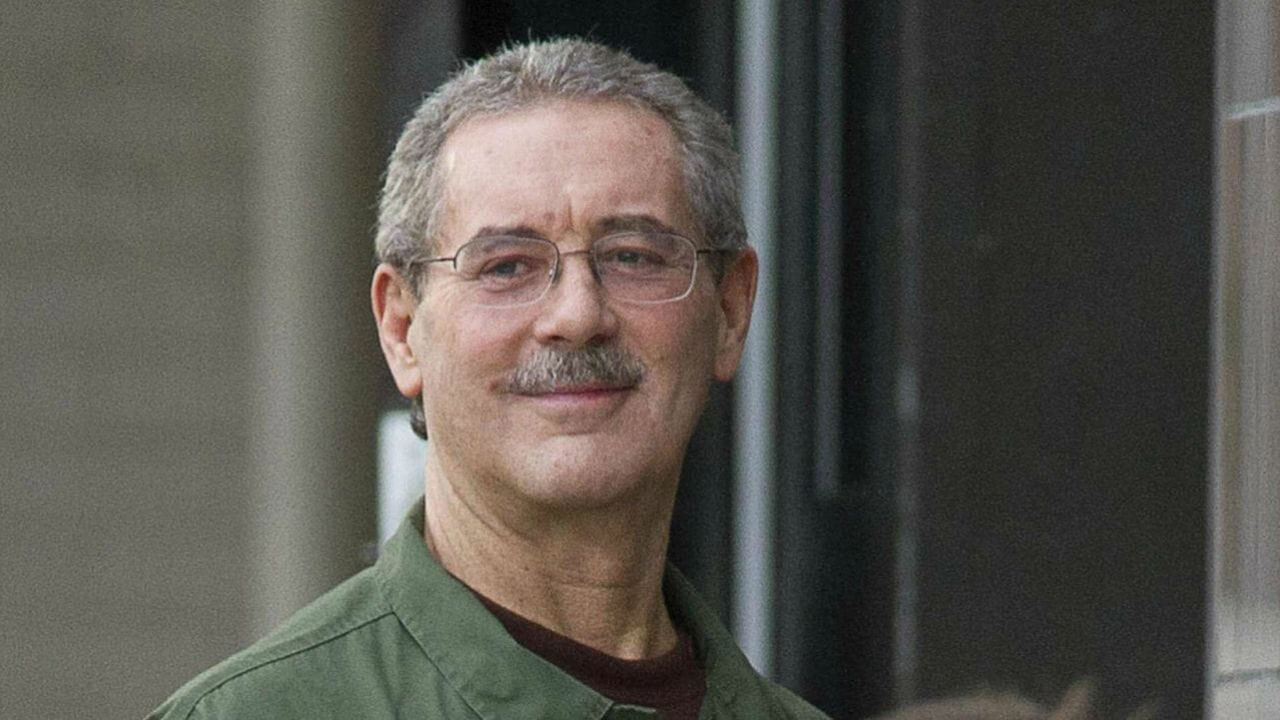

A court-appointed trustee has recovered over $ 1 billion for Allen Stanford’s Texas pyramid scheme victims, the second-largest financial fraud after Bernard Madoff. His lawyers informed about the progress of the receiver’s work.

The $1 billion threshold was exceeded when Ralph Janvey, the trustee in bankruptcy of Stanford Financial Group, received $65 million in a June 2016 settlement with insurers, including Lloyd’s of London, which finally received final approval from years of litigation. court.

The procedure lasted for 20 years

Janvey expects to be able to withdraw the settlement money in the first quarter of 2022. By April 29, he received court approval to pay out approximately $550 million, of which he made $443 million. Once considered a billionaire but later declared a pauper, Stanford is serving 110 years in prison after being convicted in 2012 of running a $7.2 billion financial pyramid that fell to some 18,000 investors.

According to prosecutors, Stanford sold fake high-yield certificates of deposit through its Antigua-based Stanford International Bank and used investors’ money to make risky investments and finance lavish lifestyles. The scam lasted about two decades and was revealed in February 2009.

The receiver is working on recovering more funds

– At the beginning of the work of the receiver from a bank that was to store over USD 7 billion, only USD 63 million was recovered. It took 12 years to hit $ 1 billion, but this is a significant achievement, said Kevin Sadler, a Baker Botts partner representing Janvey.

Further recoveries cannot be ruled out. Janvey is still defending appeals against the $124.9 million judgment he received against Colorado billionaire Gary Magness. He is also collaborating with the Official Stanford Investors Committee on a $4 billion lawsuit against five former Stanford banks, including HSBC, Societe Generale and TD Bank.