Profit-Fueled Inflation Tamed by Sustained High Rates, Suggest Investors

Spiraling corporate profits are exacerbating inflation, and maintaining elevated interest rates is a crucial step in curtailing them, according to a recent poll conducted among professional and retail investors by Bloomberg.

Key Points:

- Almost 90% of the 288 survey respondents believe corporations have been escalating prices beyond their own costs since the 2020 pandemic onset.

- Tight monetary policy is deemed the correct response to profit-driven inflation by approximately four out of five surveyed individuals.

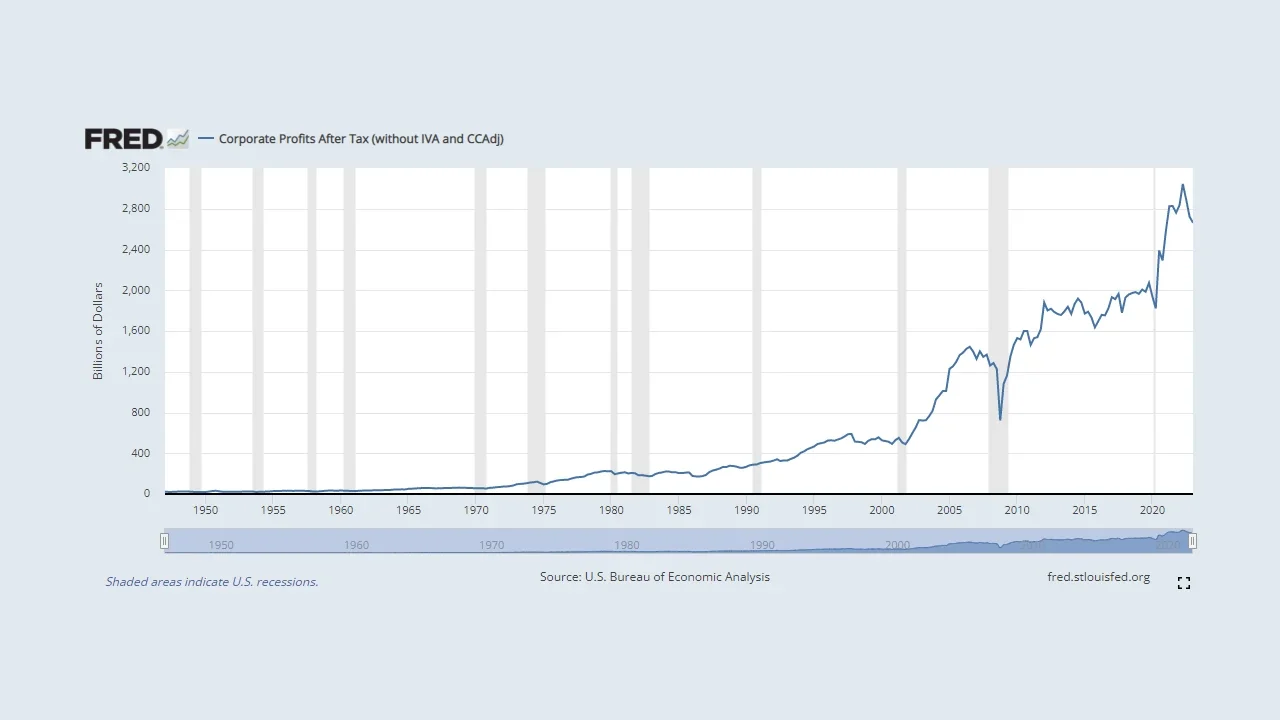

- Profit margins, which reached 70-year highs in the U.S. during the pandemic, are expected to return to pre-Covid levels, according to 53% of respondents.

- Alternatives to tighter monetary policies suggested by one-quarter of respondents include stricter anti-monopoly regulations and increased corporate tax rates.

Decoding Inflation Triggers

The rampant inflation surge, one of the worst in several decades, has led to the exploration of various potential causes. Disrupted supply chains, rampant government spending, and escalating wages have all been implicated. However, one factor drawing attention is the increase in corporate markups.

Profit margins soared during the initial years of the pandemic and have since remained unprecedentedly high. This phenomenon prompts two critical inquiries: Are amplified profits contributing to embedded inflation? If so, what strategies should be implemented to address it?

A Profits-Inflation Nexus

Central to the debate is whether different types of price pressures necessitate diverse solutions instead of a uniform response such as raising interest rates. Approximately one-quarter of the MLIV Pulse survey participants proposed alternative solutions, including the implementation of tougher anti-monopoly rules and utilizing corporate tax rates against price manipulators.

The Road Ahead

Despite the unique circumstances caused by the pandemic, such as severe supply restrictions followed by a burst of stimulus-fueled demand, most survey participants anticipate that profit margins will return to pre-Covid levels. However, if firms exploit their monopoly power to maintain high margins, more direct intervention may be required to curb this profit-led inflation.