The Australian branch of IC Markets ends its services for clients from Europe

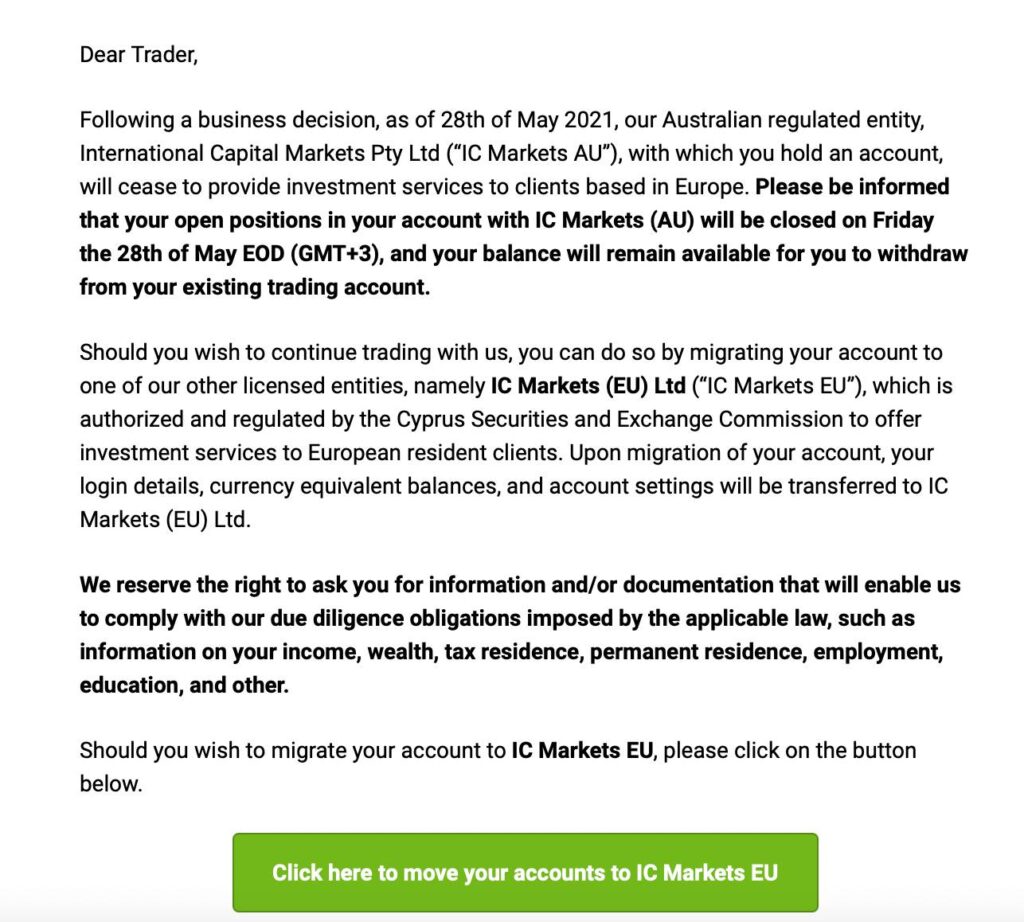

IC Markets AU ends the service of accounts belonging to persons from the European Union – this results from the mailing sent to customers affected by the changes. The cut-off date is May 28.

According to the information sent to clients from Europe who have accounts at the Australian branch of the broker, investors may transfer their accounts to IC Markets EU, an entity regulated by the Cyprus Securities and Exchange Commission (CySEC). After migration, the user will have access to an account with the same login, password, funds, and account settings.

Thanks to the conversation with the support of IC Markets, we have established that EU traders can also choose a broker branch regulated in Seychelles. Clients can migrate their accounts if they don’t have any open positions. You can check them here. By switching an account to Seychelles, the broker’s clients can enjoy higher leverage, up to 1: 500 (which, however, involves a high risk for their funds).

The changes introduced from May 28 apply only to people who have accounts in the Australian branch of IC Markets. They are probably a consequence of regulatory changes introduced recently by the ASIC. At the end of March this year, a product intervention came into force on the local Forex / CFD market, which limited the level of financial leverage and introduced many restrictions.

6-figures withdraw wasn’t resolved for 50+ days. I was ping-ponged between departments and I still don’t have any kind of information that will put this situation to rest. Contacted regulator as a last resort.