The FOMC is accelerating tapering, but not raising interest rates

The two-day FOMC meeting brought a decision on the further direction of US monetary policy. The deceleration of quantitative easing (tapering) will end in March 2022, and interest rates will increase in the following months.

Yesterday at 20:00 Polish time ended the meeting of the Federal Committee for Open Market Operations (FOMC). It was decided to double the pace of moving away from quantitative easing at the meeting. Each month, the Fed will buy $ 30 billion in bonds less (previously $ 15 billion) to complete its tapering in the first quarter of next year. This will lay the foundation for interest rate hikes.

The feasibility of such a scenario was signalled by the chairman of the Federal Reserve, Jerome Powell, on November 30 during his speech to the Senate. The change in the Fed exchange rate was the strengthening of inflation, which in October reached 6.2% y / y, i.e. a 30-year high. The Federal Reserve no longer described the inflationary pressure as temporary at its December meeting. The FOMC has raised the inflation forecast – from 4.2% to 5.3% at the end of 2021 and from 2.2% to 2.6% in 2022.

US interest rates

At the post-meeting press conference, Powell said interest rates would not increase until the tapering. This is in line with the updated projections that suggest that the Federal Reserve will probably start raising them by June next year (May at the earliest).

The Fed’s quarterly economic forecasts show that 12 of the 18 monetary policy committee members agree that the conditions warrant a rise in interest rates by at least 75 basis points in 2022. If in 2 years there are 3 consecutive increases, indicated by 11 out of 18 policymakers, the US reference rate will be between 1.5-1.75% in 2023.

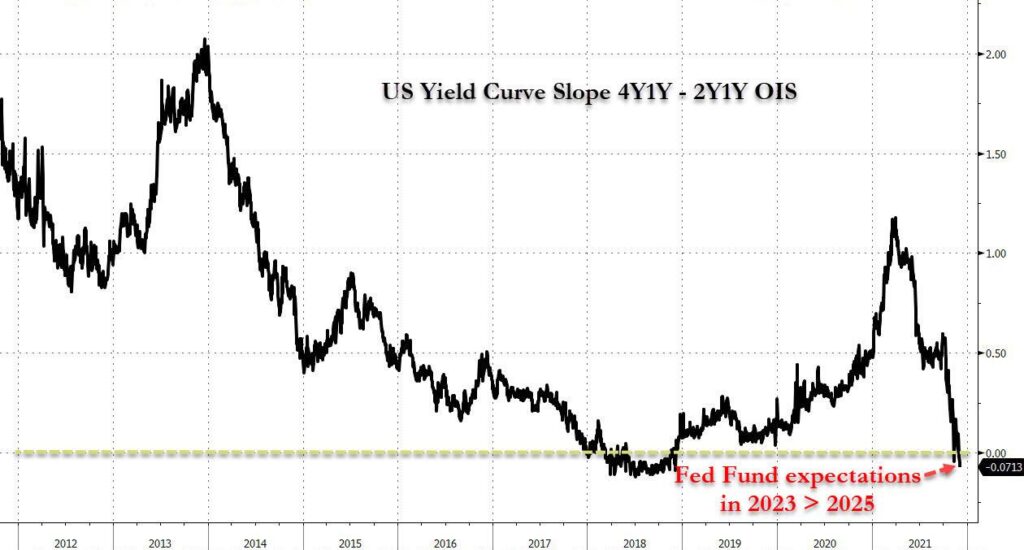

The stock market, gold, reserve currencies paired with the dollar and cryptocurrencies strengthened their quotations after the Fed conference results. Some observers suggest that a tightening of the policy could lead to an economic slowdown and a recession between 2023 and 2025, as evidenced in their opinion by the inverted curve in the US government bond market.

Data: ZeroHedge