The shelling of the Ukrainian nuclear power plant increases the pressure on the financial markets

Forcing Russia to the margins of the world economy by means of sanctions has not yet cooled Vladimir Putin’s enthusiasm. On Friday after 3:00 am, Russian troops attacked the nuclear power plant in Zaporizhia – the largest complex of this type in Europe.

A fire at the Ukrainian nuclear power plant increases pressure on financial markets

The shelling started a fire, but Ukraine says it did not observe any elevated levels of radiation. However, the state does not ignore the risk – as President Volodymyr Zelensky said:

“There are six power blocks here. Only one erupted in Chernobyl. […] If it does, it will be the end of Europe.”

Zelensky, calling Russia a “terrorist state,” added that the shelling was not a coincidence – Russian tanks are to be equipped with thermal imaging cameras.

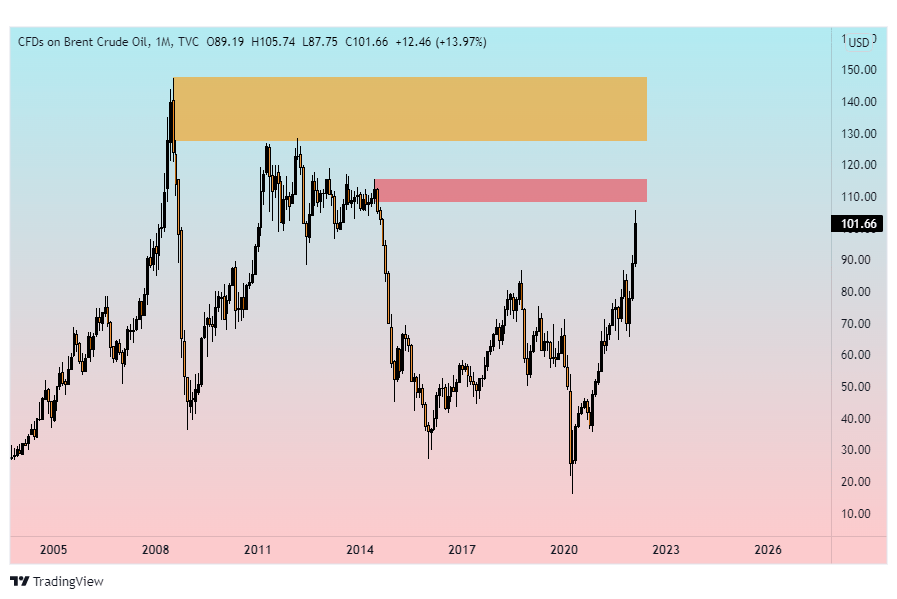

Stock exchanges reacted to the higher level of risk in Europe. The Japanese Nikkei index fell by about 2.5%, the Hong Kong Hang Seng index – 2.6%. Due to the situation in the east of the Old Continent, the price of Brent crude oil reached a record of almost $ 120 per barrel during yesterday’s session, breaking the monthly supply zone.

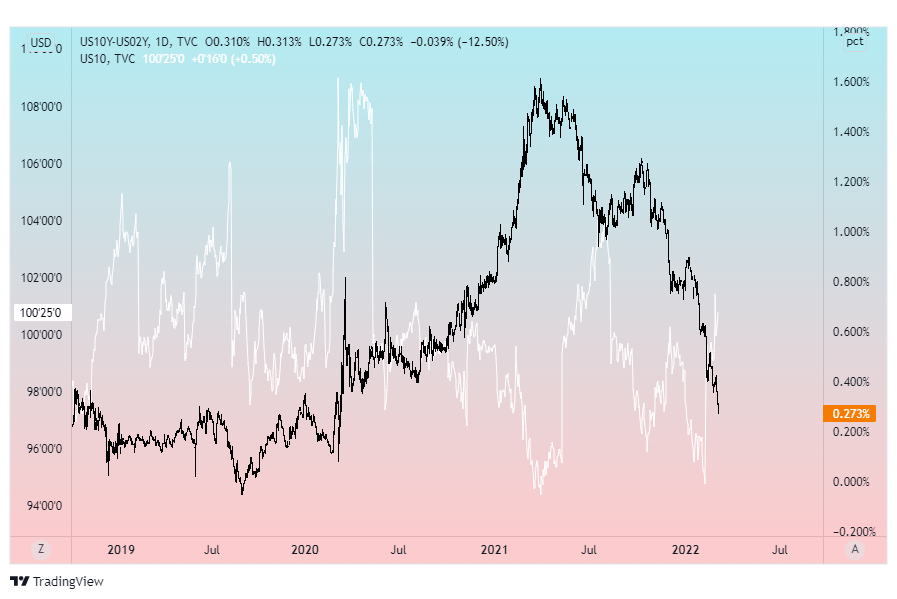

Chart 1. Spread of the yields of 10-year and 2-year US treasury bonds. The white line chart shows the price of a 10-year bond.

Analysts also point to the lower yield spread on 10-year and 2-year US treasury bonds. The difference is the lowest since March 2020, which may be interpreted as a harbinger of an economic slowdown.

City Index Senior Financial Markets Analyst Fiona Cincotta said:

“The biggest economic problem of this war is commodity prices. Higher energy prices, slowing growth and rising inflation do not offer good prospects.”